Invoice template UK

Create a free VAT or non-VAT invoice online for the United Kingdom using our invoice generator for the UK. Or download an invoice template in Excel or Word.

Make receiving money internationally effortless, with a Wise Business account. Get local bank details to receive fee free payments - fast - from 30+ countries. Find out more.

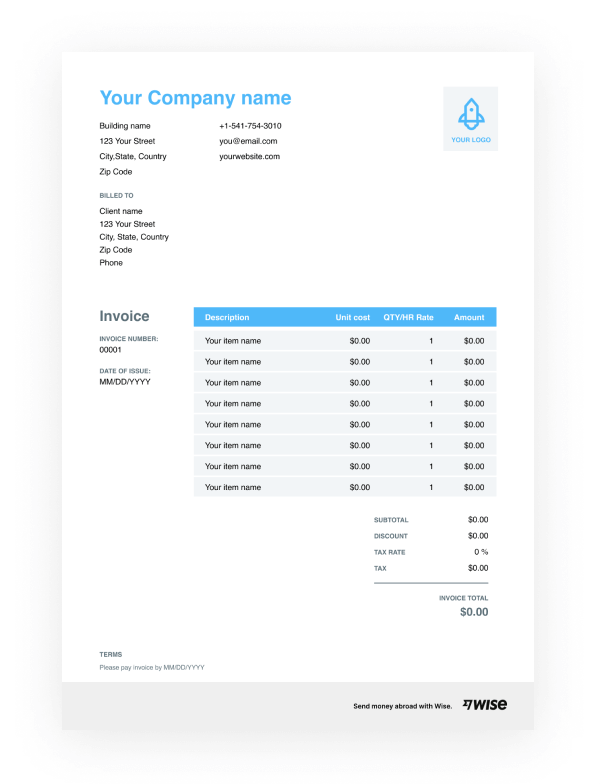

How to create a UK invoice online.

1. Fill in your company and contact information, date and invoice number.

Create a professional first impression and make it easy for your client to see all your company and contact details. Using sequential invoice numbers also makes it easier to track and reconcile paperwork and payments.

2. Include line items with descriptions of billable work, and agreed rates.

Enter all the details of the work you’re invoicing. Add line by line details of billable work, including a clear description, piece or hourly rate, and quantity.

3. Add tax and calculate the amount due, noting payment terms.

In the tax field on the UK invoice maker you can choose to add the VAT or not. In the UK the VAT is 20%. Double check all your information, and add in other important payment details like the currency and requested payment deadline. Make sure you’ve included your full bank details so your customer can settle up.

4. Download your invoice as PDF.

You’re ready to download your completed document as a professional looking PDF, adding password protection if you need it. Send it to your client by email to get paid quicker.

5. Get paid using your Wise bank account details.

Get paid for free using your local bank details for the US, UK, Eurozone, Australia, New Zealand and more. Simple.

Money management made easy.

Do you work with customers, suppliers and employees abroad? Then it’s time to say goodbye to slow and costly international transfers and meet Wise Business.

With Wise, you can set up local account details in 10 major currencies and receive fee-free payments just like you would domestically.

Effortlessly pay international invoices, vendors, and employees. Send money in 54 currencies, to 80 countries — all with the real exchange rate. Check your account, move money, and manage transactions. All in one place.

Get these local account details

These are the account details you can share with others to receive money. Anyone can use these to pay you just like they'd pay a local.

GBPBritish Pound

Get your own Account Number and Sort Code.

EUREuro

Get your own SWIFT/BIC and IBAN details.

USDUS Dollar

Get your own Routing (ABA) and Account Number.

AUDAustralian Dollar

Get your own BSB Code and Account Number.

NZDNew Zealand Dollar

Get your own Account Number.

SGDSingapore Dollar

Get your own Account Number.

RONRomanian Leu

Get your own SWIFT/BIC and IBAN details. Currently only available to residents of the UK and Romania.

CADCanadian Dollar

Get your own Institution number, Transit number, and Account number.

HUFHungarian Forint

Get your own Account Number.

TRYTurkish Lira

Get your own Bank name and IBAN.

Hold and convert money

You can hold and convert money in 40+ currencies. It only takes a few seconds to open a new account in the currency you need.

GBPBritish Pound

AUDAustralian Dollar

AEDUnited Arab Emirates Dirham

BDTBangladeshi Taka

BWPBotswana Pula

BGNBulgarian Lev

CHFSwiss Franc

CLPChilean Peso

CNYChinese Yuan

CRCCosta Rican Colón

CZKCzech Koruna

DKKDanish Krone

EGPEgyptian Pound

GELGeorgian Lari

GHSGhanaian Cedi

HKDHong Kong Dollar

Send money to 73 countries

You can send money in your Wise account to any of the currencies we support.

United Arab Emirates Dirham

Australian Dollar

Bangladeshi Taka

Bulgarian Lev

Brazilian Real

Botswana Pula

Canadian Dollar

Swiss Franc

Chilean Peso

Chinese Yuan

Costa Rican Colón

Czech Koruna

Danish Krone

Egyptian Pound

Euro

British Pound

Georgian Lari

Ghanaian Cedi

Hong Kong Dollar

Hungarian Forint

Indonesian Rupiah

Israeli Shekel

Indian Rupee

Japanese Yen

Kenyan Shilling

South Korean Won

Sri Lankan Rupee

Moroccan Dirham

Mexican Peso

Malaysian Ringgit

Norwegian Krone

Nigerian Naira

Nepalese Rupee

New Zealand Dollar

Philippine Peso

Pakistani Rupee

Polish Zloty

Romanian Leu

Swedish Krona

Singapore Dollar

Thai Baht

Turkish Lira

Tanzanian Shilling

Ukrainian Hryvnia

Ugandan Shilling

Uruguayan Peso

US Dollar

Vietnamese Dong

West African CFA Franc

South African Rand

Zambian kwacha

Invoicing in the UK.

If you have a registered business you’ll need to make sure your invoicing process is compliant with the tax and other legislation in your home country. If you’re selling internationally, the rules in the country you’re selling to may also impact the information you must include in an invoice.

Different countries have slightly different rules about the information that must be captured in an invoice.

If you’re a UK registered business, or if you’re selling goods and services to the UK, you may need to register for VAT and provide VAT compliant invoices to customers. It’s also important to remember to offer either electronic or hard copy invoices every time you make a sale, and retain all transaction receipts.

Retain all invoices for at least 3 months so you can fulfil quarterly VAT reporting requirements. Hold on to all of your invoices, even if they were created in error, cancelled or charged back.

| UK Invoice Requirements |

|---|

Date of sale |

Unique, sequential invoice number |

Your VAT number |

Your full address |

Description of doods & services provided |

Quantity of goods provided |

Supply if different from invoice date |

Net taxable value of the sale in sterling |

Unit price of items supplied excluding VAT |

Details of cash discounts excluding VAT |

VAT rate & amount |

Details of the transport of goods |

UK VAT tax information on invoices.

The standard rate of VAT - which applies to most goods and services sold in the UK - is 20%. However, some categories of goods are subject to reduced rate VAT, which sits at 5%, and other goods and services benefit from a zero rate VAT. Items falling into the 5% bracket include children’s car seats, smoking cessation products and things connected to home energy and heating. The zero rate VAT applies to most essential food and drink, as well as some childrens goods.

As a business you’ll need to collect VAT from the customer at the point of sale, and then pass this on to HMRC when you file your VAT return. You’ll need to pay HMRC the VAT due on goods and services even if you don’t pass the cost of this tax on to your customers.

If you’re a distance seller in the UK you can register for UK VAT by sending form VAT 1A to HMRC at the following address:

VAT Registration Service

HM Revenue & Customs

Crown House

Birch Street, Wolverhampton

WV1 4JXHMRC

Download a free UK invoice template.

To receive the download link on your email, please enter your email address. When you enter your email, you’ll also be signed up to receive the Wise Business newsletter, our free email packed with handy guides and tips on how to grow your business internationally. You can unsubscribe at any time.

By subscribing, you agree to receive marketing communications from Wise. You can unsubscribe at any time using the link in the footer of our emails. See our privacy policyFAQ about creating an invoice.

What is an invoice?

An invoice is an itemized bill, issued by anyone selling goods or services. An invoice will detail the agreed prices or fees, and list out the products or services that have been provided. Upon receipt, the buyer will settle the invoice. Invoices have a practical purpose - making sure you get paid for goods or services you’ve provided a customer. They can also help to create a professional impression, and build client relationships, as well as acting as a legal record of sales made.

Can I edit my UK invoices?

Yes. Simply edit the information in our free invoice generator tool and add your own company logo to give a professional finish. Create your PDF UK invoice when you’re ready - and continue to edit your invoice with a PDF editor tool if you need to. You can also get a fully customizable solution by using our invoice templates which come in Google Docs, Google sheets, Word, Excel, PDF and Open Office formats.

Can I change the currency on the invoice?

Choose the currency you’re billing in by simply selecting it in the UK invoice maker. Then get paid into your Wise Business account to cut currency conversion fees and keep more of your hard earned cash.

Can I put my own logo on the invoice?

Yes, our free invoice maker lets you add your own company logo. Just select the logo box in the top right corner, and upload your logo or drag and drop it into place. Both JPG and PNG images are supported.

How do I send my UK VAT/no VAT invoice?

Create an invoice in our invoice generator and easily download a PDF copy. You can then attach it to your email or message to your client.

If you send a link to your customer, they can download or print the invoice from the link - with no need to wait for the mail to arrive.

Can I set up recurring invoices?

It’s not possible to set up recurring invoices at the moment. That’s because the invoice generator works separate from your Wise user account and no data is saved when you use it.

Can I create invoices in different languages?

At the moment the invoice generator only creates invoices in English.

However, we have great free invoice templates available in 6 different languages - English, French, German, Spanish, Japanese and Cantonese. Pick the language and the format you need and create an invoice in just a few moments.

Get paid faster. With Wise

Open your local bank account details, connect with customers, suppliers and staff, and watch your business soar.