Independent contractor agreement template

Create an independent contractor agreement and send it to your client.

Create an independent contractor agreement

Use one of the downloadable free independent contractor agreement templates to create a simple contractor agreement covering your work as a freelancer.

Send your independent contractor contract

Send your independent contractor contract to your employer before starting any work for them. Use a common format like Microsoft Word, so it’s easy for anybody to agree and sign.

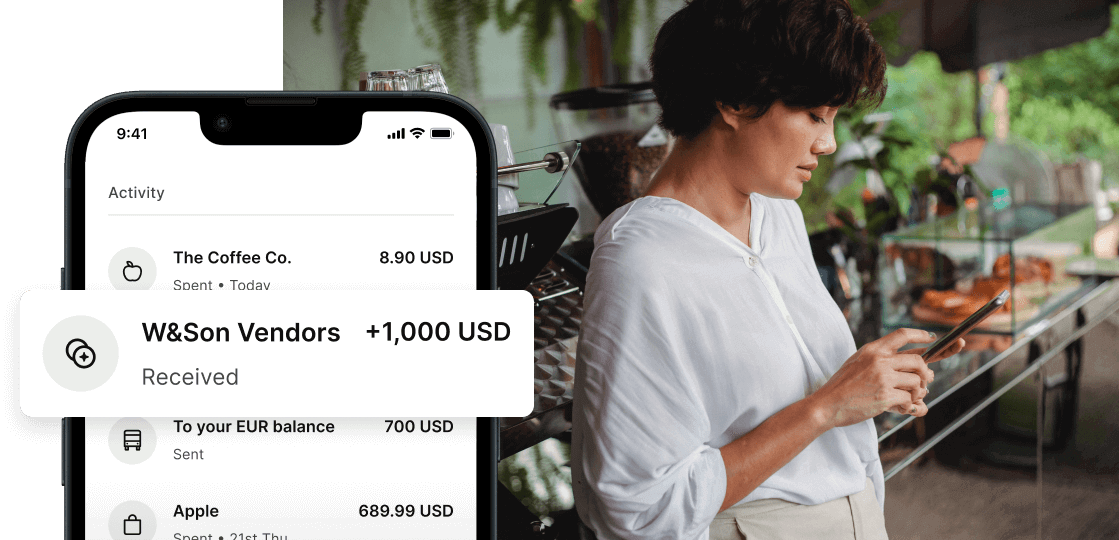

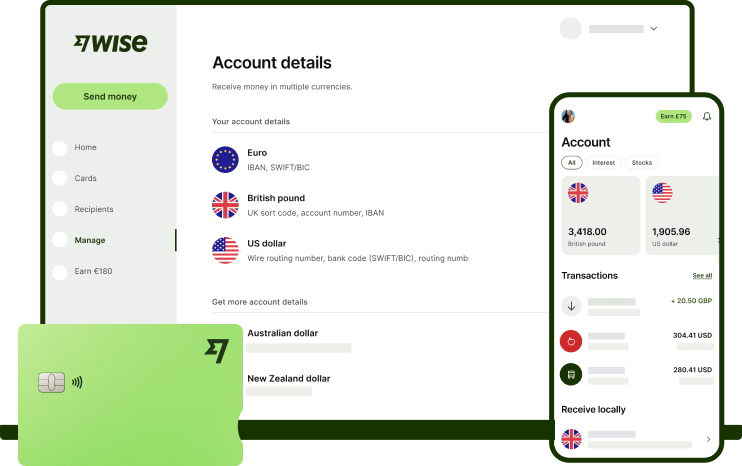

Get paid with Wise

Open a Wise Business account online, with no monthly fees to worry about. It’s free to receive money from around the world.

Download an independent contractor contract.

You should always have a written agreement for freelance work. Without a contract, misunderstandings are common. Having one is an important first step in protecting your business and your clients. So we’ve gathered together a few of the best free contract templates for independent contractors. They’ll help you outline the job requirements and payment terms, and they’re available in widely-accepted formats like Microsoft Word or Google Docs.

- A thorough independent contractor agreement template from legaltemplates.net

- This customizable and simple independent contractor agreement template by Ryan Robins

- An easy to fill general contractor contract template by Jyssica Schwartz

- This flexible work for hire agreement template from Docsketch

While we've done our best to find useful contract templates for you, this isn't legal advice, and Wise cannot be held responsible for the content of external sites. These contract templates are a great resource to get your freelance business up and running quickly, but if you need legal advice you should always consult a lawyer.

What is an independent contractor?

An independent contractor is a self employed worker. The exact definition can vary depending on your country. But generally an independent contractor can be contracted by different businesses to complete project work, or to deliver specific services. And so they remain independent contractors - not employees - because they are free to work for several different businesses at once.

Employing a freelance professional can be a smart way to bring skills into the team for short term work, without the costs of hiring a full time employee. Freelance talent is flexible, and the company hiring them won’t need to pay employment benefits like vacation or sick pay.

Freelance workers are often in skilled professions, such as web designers, journalists, photographers, tradesmen or even actors. However, your babysitter, dog walker, or even the neighborhood kid who mows your lawn on a weekend is technically a freelance worker.

Open a Wise Business account online and in just a few minutes.

If you’re an independent contractor you need a smart way to get paid, and easy access to your money without excessive fees. With a Wise Business account you can receive payments from all over the world — perfect if you work with international employers.

You’ll get your own local bank details for the US, UK, euro area, Australia, New Zealand or Poland. Use them when you create your freelance invoice, to get paid like a local from these major regions. Hold 40+ different currencies, and move money between them at the mid-market exchange rate.

You’ll also be able to cut your admin time with batch payments, Xero integration and automation with our powerful open API.

Doing business in multiple currencies? Try Wise Business

What is an independent contractor agreement?

An independent contractor agreement is a document that clarifies the terms of a job for which a company

is hiring the contractor for. If you’re an independent contractor or a company hiring one, you’ll need to create an independent contractor agreement for each job you take on.

Having an agreed contract in place before starting work is important to make sure the independent contractor

and the employer have the same understanding of the scope of work, and how the contractor will be paid.

The contract protects both the freelancer and the business. Both parties will be able to avoid unnecessary

misunderstandings, and tackle disagreements about how the work should be done before it starts. The independent contractor can also write terms into the contract to protect themselves, such as charging

a deposit for new customers, or using penalty fees for late payment.

When do you need an independent contractor contract?

For an employer, using freelance professionals can be a smart way to cover busy periods or to buy in skills their regular team is lacking.

The employer isn’t obligated to pay for the independent contractors vacation time or sick leave, or even deal with their taxes - an independent contractor is not an employee. Due to this, hiring a freelancer can be cheaper for the company than recruiting, training and paying new employees.

All that said, you’ll want to prepare proper contracts for any freelance work, to avoid ambiguity. A contract will lay out the details of the work agreed, including the deadlines, key deliverables and the pay rate.

What should be included in an independent contractor agreement?

The names of the two parties — The names and contact details of the two parties agreeing the contract.

Scope of the project — Establish clear guidelines around the scope of the project, so that both parties have agreed on a set ending point for the project.

Services that will be provided — The services the freelancer will provide the client in as much detail as possible, and how any changes or additions to the original project will be dealt with.

Schedule and dates — Schedule and dates, covering milestones and deadlines for completion.

Clarification of your legal relationship

Compensation — Get paid with Wise — Set clear payment terms so the freelancer gets paid on time.

Termination — Should the working relationship not work for some reason, the termination clause will allow either parties to exit the agreement.

The signatures of both parties

What if I don’t have an independent contractor agreement?

Starting work for a client without an independent contractor agreement in place might lead to misunderstandings which could result in lost payment or extra work.

The freelancer may find their work is used without giving them credit, or even face penalties if they don’t have the right documents to complete their tax return.

Employers using freelance professionals without a contract in place also risk losses in terms of time, money and legal expenses.

An independent contractor may need to file a 1099-MISC form with the IRS to report freelance earnings. A company employing independent contractors, will need to complete a 1099-MISC form if payments to individual contractors reach a threshold set by the IRS. Take professional tax advice to make sure you have all the paperwork you need prepared for filing.

Freelance efficiently with Wise Business

Get the tools you need to manage your finances as an independent contractor.