Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you don’t know the rate, download the free lookup tool on this page to find the right state and local rates.

Save with Wise when invoicing clients abroad.

If you're invoicing clients abroad, you could get a better deal on your international business transfers with a Wise Business account. We give you the same exchange rate you see on Google, no hidden markup fees.

Link your Wise account to PayPal to receive and withdraw funds in different currencies to save on fees and set up direct debits for all your recurring payment needs.

- Amount of sales tax:

- 0.00

- Net amount:

- 0.00

How to calculate sales tax

Sales tax can be imposed by your state, county or locality. To get the sales tax rate you need you must add together all applicable taxes in your location.

Taxes are never simple, but our handy sales tax lookup tool can help you find the correct minimum combined local and state sales tax rate for your area.

All you need to do is enter your state, and your city or county to find the right rate for you.

Download sales tax lookup tool→

Once you know the local sales tax rate for your area you can use the sales tax formula below to figure out how much to charge your customers on each sale.

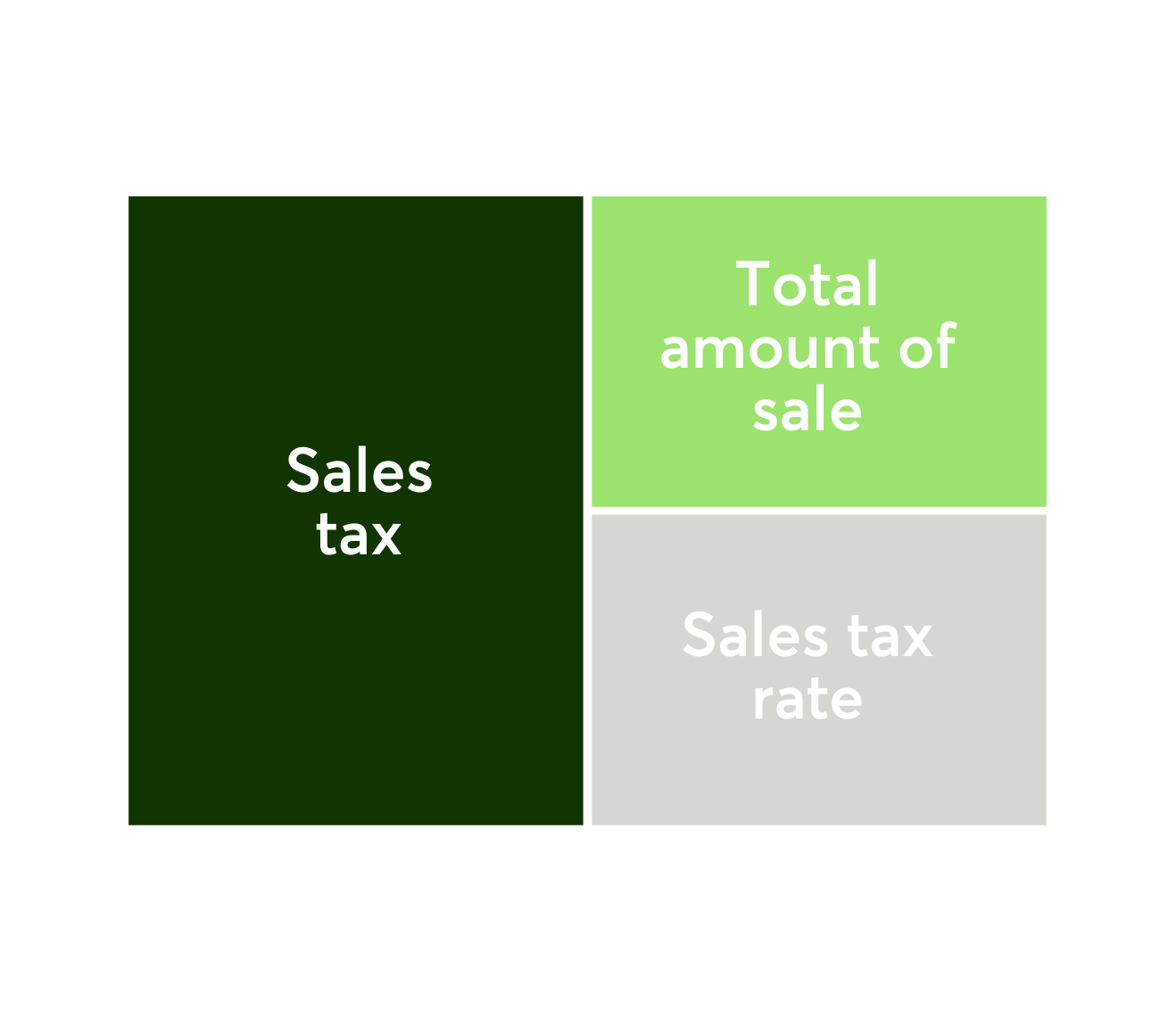

Sales tax = total value of sale x sales tax rate

Or make life even easier by using the handy calculator at the top of the page to get the sales tax detail you need.

State sales tax calculators

State sales tax calculators

| State | ||||

|---|---|---|---|---|

Save time and money with Wise Business

The easier way to connect with customers, suppliers and staff, and watch your business grow.