Sales Tax 2021

What is sales tax?

Sales tax may be added to the cost of buying goods and services at US retail locations. The amount paid varies by locality. Some 45 states, plus the District of Columbia use state-wide base sales tax rates - while there are 5 states with no sales tax at state level.

Some areas also have local sales tax rates on top of these charges. Consumers pay the combined state and local sales tax rate when they shop. However, certain products - like groceries, clothing and raw materials - may be exempt from sales tax.

Business owners are responsible for collecting sales tax from customers and then remitting it back to the state, either monthly or quarterly.

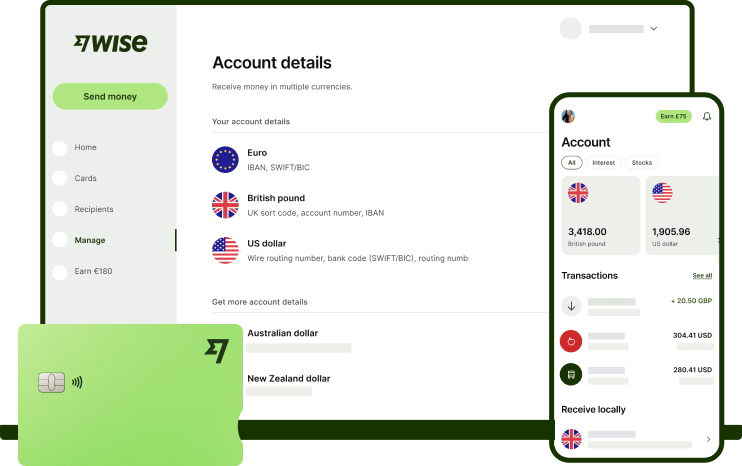

Wise is the cheaper, faster way to send money abroad.

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise Business, you can get a better deal for paying supplier invoices and buying goods overseas. We’ll always give you the same rate you see on Google, combined with our low, upfront fee — so you’ll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it's not only money you'll be saving with Wise, but time as well.

Learn more about Wise Business→

Sign up now for free, and do business without borders.

Sales tax rates by state.

Sales tax rates by state.

| State | Rate range | State | Rate range | State | Rate range |

|---|---|---|---|---|---|

4% - 11% | 4.45% - 11.45% | 4.5% - 11.5% | |||

Alaska | 0% - 7.5% | 5.5% | Oregon | 0% | |

5.6% - 11.2% | 6% | 6% - 8% | |||

6.5% - 11.5% | 6.25% | 7% | |||

7.25% - 10.25% | 6% | 6% - 9% | |||

2.9% - 11.2% | 6.875% - 8.375% | 4.5% - 6.5% | |||

6.35% | 7% - 8% | 7% - 10% | |||

Delaware | 0% | 4.225% - 10.1% | 6.375% - 8.25% | ||

District of Columbia | 6% | Montana | 0% | 4.7% - 8.7% | |

6% - 8% | 5.5% - 7.5% | 6% - 7% | |||

4% - 9% | 4.6% - 8.265% | 4.3% - 7% | |||

4% - 4.5% | New Hampshire | 0% | 6.5% - 10.4% | ||

6% - 9% | 6.63% | 6% - 7% | |||

6.25% - 11% | 5.125% - 9.0625% | 5% - 5.6% | |||

7% | 4% - 8.875% | 4% - 6% | |||

6% - 8% | 4.75% - 7.5% | Puerto Rico | 10.5% | ||

6.5% - 10.6% | 5% - 8.5% | ||||

6% | 5.75% - 8% |

How to find the right sales tax.

Sales tax varies by state. Local tax rules can mean further differences by county and city too. To find the right sales tax you’ll often have to calculate a combined state and local sales tax rate.

Wondering how to find sales tax detail for your locality? We know taxes are nobody’s favorite thing, so we’ve done the hard work for you with our downloadable sales tax lookup tool.

Simply enter your state, and county or city to find the rate you need.

Sales tax FAQs.

Save time and money with Wise Business

The easier way to connect with customers, suppliers and staff, and watch your business grow.