Brex and Wise are Solving Growing Pain Points for Employers: Global Employee Reimbursements

The “Going Global” Challenge In today’s post-pandemic world where employees can work from anywhere and companies are more frequently hiring beyond their...

To the Wise community,

You have made Wise possible. You keep our lights on, so that we can move money faster and cheaper for you today and the generations after you. The bigger our community, the faster and cheaper Wise becomes.

In 2011, Wise showed that international transfers can be 10x cheaper than a bank. We launched the service with transparent 0.5% fees, while banks were comfortably hiding a 4%-5% markup in the exchange rate.

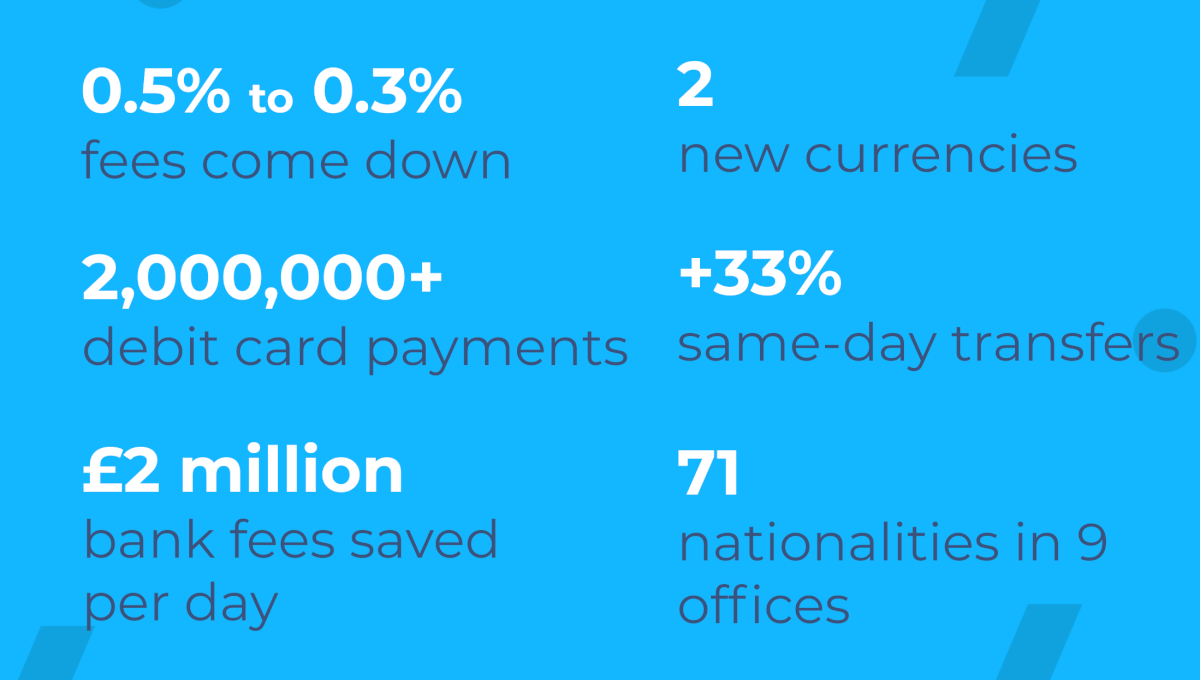

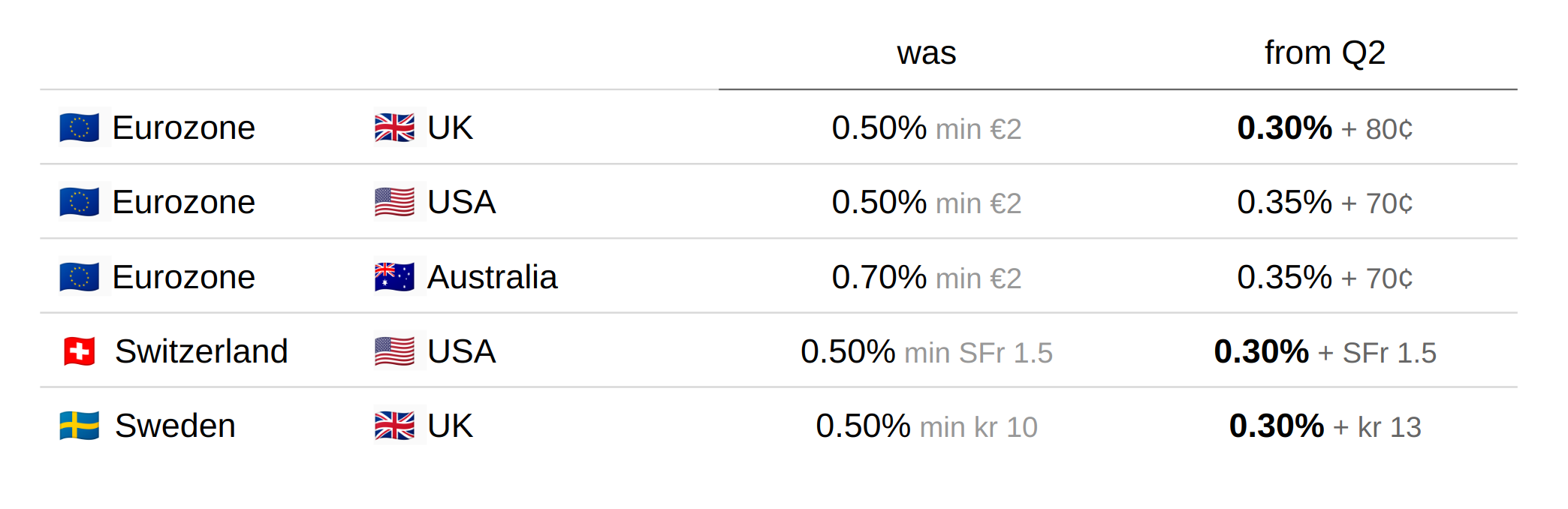

We thought that we could make it work at 0.5%, but it wasn’t easy. On some expensive routes we set the fees at 0.7% or even higher. By the end of 2017, we had achieved enough scale, thanks to people like you recommending Wise, that we could start bringing the fees down from the original 0.5%.

In the last 3 months, we’ve finished the re-pricing all of our 1,300 currency routes and established the new standard: 0.3%. This is a selection of larger routes before and after repricing:

We are in a unique position today. We can fund our growth, invest 200 engineers’ time into product development and still remain in the black at the end of the month. We are fixing a large broken industry, where consumers have been grossly underserved by banks. Wise is proving that a company can be transparent, drive down prices, and remain profitable all at once.

Now, as the icing on the cake, we can further challenge the market by regularly setting new standards as to what businesses and individuals should expect as a price point. 0.3% is the new standard.

We consider a payment instant, when it takes less than 20 seconds to move from your bank in one country to another bank in a different country and currency. While nearly all of our UK payouts are instant, we paused instant EUR payouts in the Target2 network, the Eurozone’s real-time settlement system. This leaves us with only 8.3% of transfers being instant on Wise across all currencies.

The great news is that the general speed of transfers is getting faster due to millions of little optimisations. The share of transfers arriving on the same day increased +33% and now make up 36% of our transactions, in addition to the 8.3% that are instant.

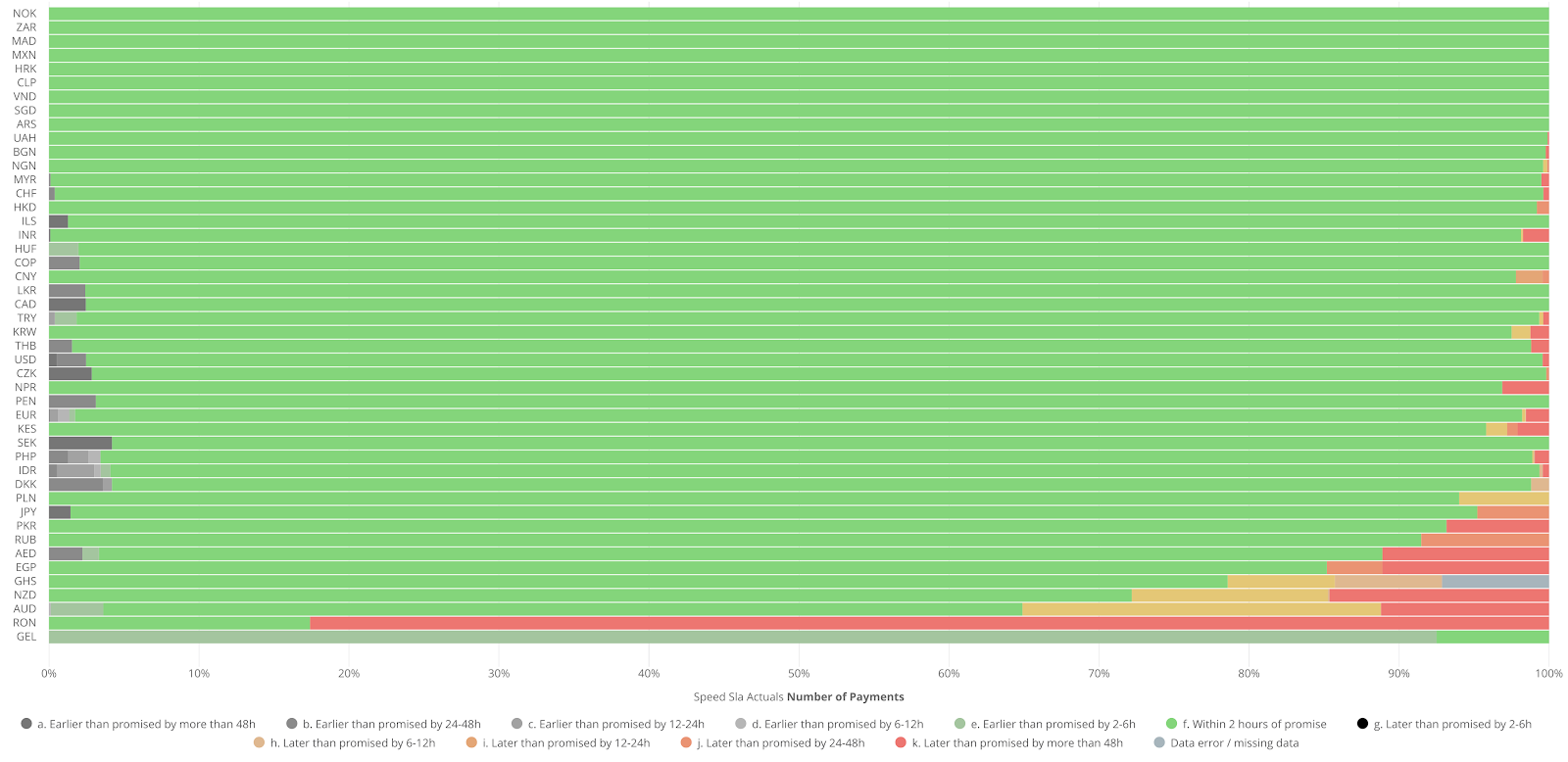

Last quarter we focused on accurate “delivery times”, i.e. when will the money be available in the recipient’s bank account for them to use. Here’s a snapshot of our daily accuracy monitor from a recent Friday. All the green refers to payments, which get delivered in a 2 hour window of the estimate. The greyish colours indicate when the money has arrived earlier than we estimated, orange and red show when it was late.

In Q2 we brought all the remaining currencies, bar BRL and GBP, onto this level of tracking.

In Q1, we reported that £1bn of deposits have been made into borderless account balances. The borderless account has turned out to be a great tool for people, freelancers and businesses, who are getting paid abroad, who pay their suppliers or who manage their lives and money cross borders. Last quarter, we rolled out debit cards to Europeans, who have since made 2 million payments from their borderless balances directly in the right currency, wherever they are.

On the 21st of June, we had an outage at one of our data centres. In the process, a power surge destroyed some of our equipment, which had to be replaced. It took us 12 hours to get all the services back up and running. This obviously affected our users, as they had no access to borderless balances and their debit cards were declined during this time. This isn’t the service you expect from us, but it inspired us to increase the speed of our hosting and platform work.

Transfers from Turkey went live, we opened to businesses in Hong Kong and added Argentina and Ghana as destinations. Our goal is to make Wise available to every person, regardless of where they live. Yet, we carefully balance opening new routes with making existing ones better. This quarter we improved the Brazil service for our customers by increasing the amounts that people can send and making it possible to pay with bank transfers in addition to boletos.

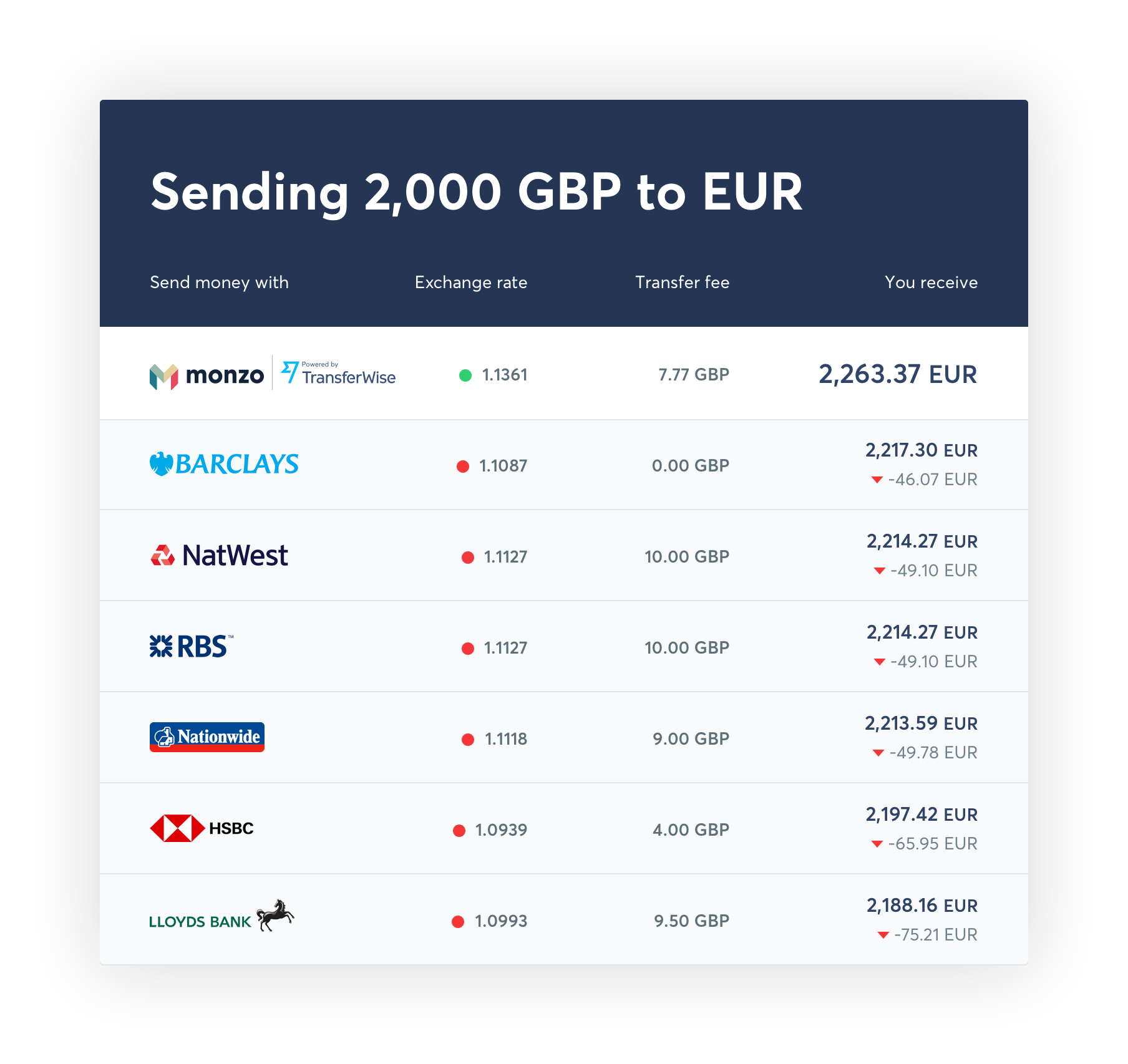

Monzo users can now use Wise directly from within their banking app. Not only do we share values with Monzo such as transparency, a lot of our customers would be using Monzo for their banking and some Monzo users were already using Wise to send money overseas. We just made it easier for them. The knock-on benefit of this is that Monzo just became 6x cheaper to send money abroad than any other bank in the UK. On launch day we ran a little comparison.

Wise and BPCE, the second largest French banking group, announced that soon 15 million Banque Populaire and Caisse d’Epargne customers will be able to use Wise from their banking app in the same way Monzo and N26 users already can today.

Wise can only achieve its mission thanks to the 1000+ people who build and improve it every day. We all meet in the summer in Estonia - this time it was a weekend in June, getting to know the 400 new joiners who joined since the last summer days.

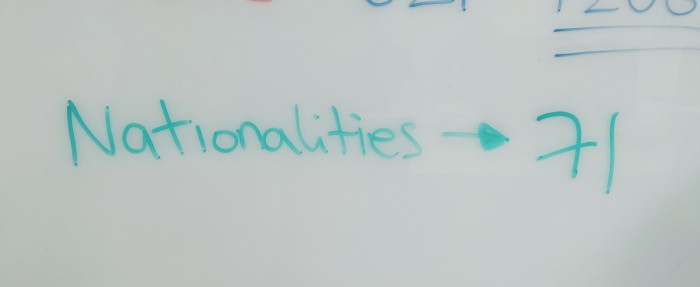

When you walk past our people team desk in London you’ll find this awesome fact on their whiteboard: how many different nationalities work in Wise?

Yes, we want help. We're looking to fill ~200 positions across 138 roles in our 8 offices in London, Tallinn, Budapest, Tampa, Singapore, Cherkasy, Tokyo, New York.

Take part of the next phase in our mission.

Onwards.

Kristo

PS. Find our Q1 2018 mission update here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

The “Going Global” Challenge In today’s post-pandemic world where employees can work from anywhere and companies are more frequently hiring beyond their...

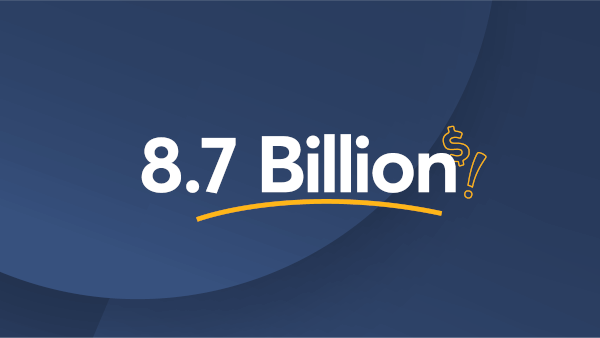

Hidden exchange rate markups estimated to cost Americans $8.7 billion in 2019 Consumers and businesses lose billions every year when they send and spend money...

We’ve just finished Q3. It’s time for an update on how much closer we’ve got to making our mission of Money Without Borders a reality.

Our mission has become irreversible, the company financially independent, and adoption continues to accelerate. Thank you - Wise customers - for...

To the Wise community When my co-founder and I launched Wise 7 years ago, we set out to irreversibly fix how money doesn’t work across...

Money is information. Using, storing and moving money should be as cheap and instant as exchanging information. As cheap as sending an email. And certainly it...