Brex and Wise are Solving Growing Pain Points for Employers: Global Employee Reimbursements

The “Going Global” Challenge In today’s post-pandemic world where employees can work from anywhere and companies are more frequently hiring beyond their...

TL;DR

To the Wise community,

We’ve just finished Q3. It’s time for an update on how much closer we’ve got to making our mission of Money Without Borders a reality.

There are now over 6 million people using Wise to move well over 4 billion pounds a month. It’s your fees that allow us to continue making progress, so it’s important we share regular updates on how we’re investing your money.

Read on to find out how much closer we got to achieving our mission this quarter: Money without borders: instant, convenient, transparent, and eventually free.

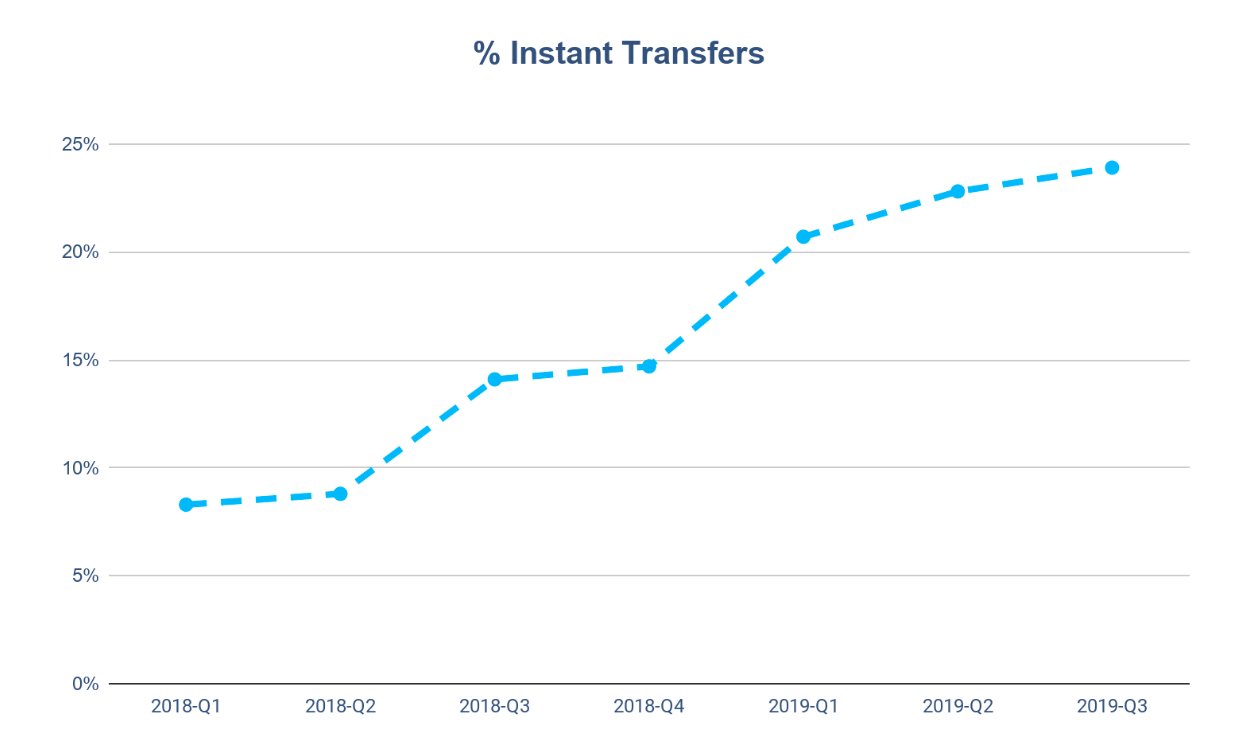

We made good progress in Q3 on increasing our speed. Today, almost 24% of transfers arrive in less than 20 seconds. This is up from 23% last quarter and 21% in Q1.

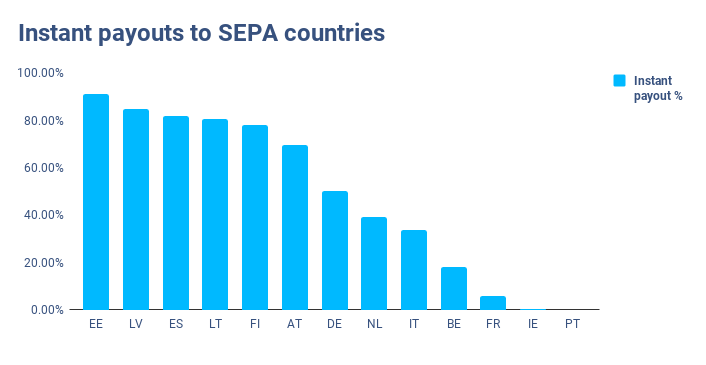

The share of instant payments improved in Q3 as more banks in Eurozone upgrade their ability to receive instant payments. How do European countries compare for instant?

While the overall level of 20 second bank-to-bank transfers is at 24%, once your money is already in Wise on your Borderless balance or at one of our partner banks, such as Monzo, N26 - then it reaches 35% of recipient banks in 20 seconds and 83% recipients in under 12 hours. The remaining 17% are the slow destinations: payments over weekends to the US, for example.

On this note, our US team improved transfers via ACH sent over the weekend. Now your transfers started from the US on Saturday or Sunday arrive 24h sooner than before.

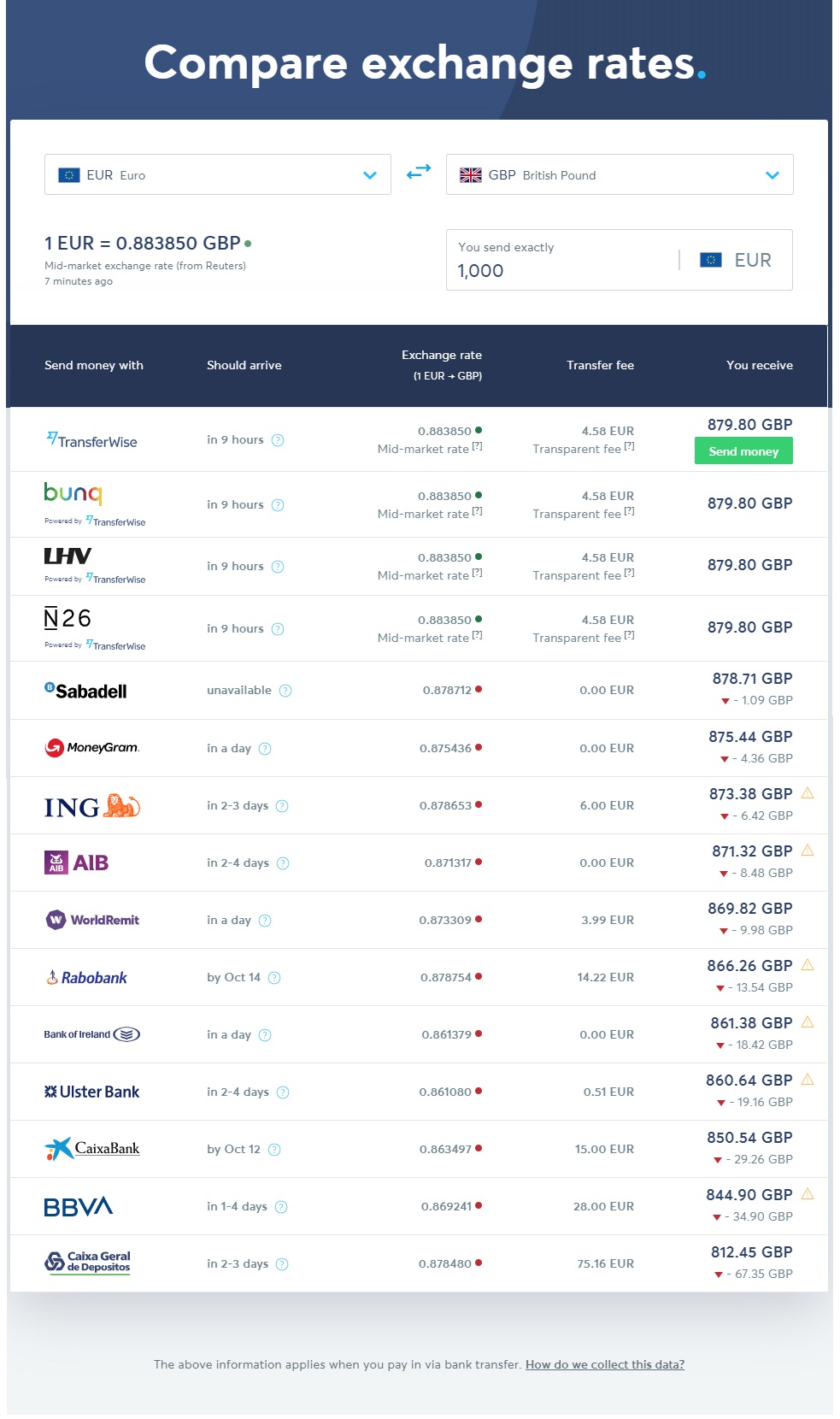

We don’t know how often banks miss their delivery dates. But we do know how long they say they’ll take. So this quarter, we’ve embedded banks’ speed estimates in our comparison tables, helping you find the quickest way to get your transfer to its destination.

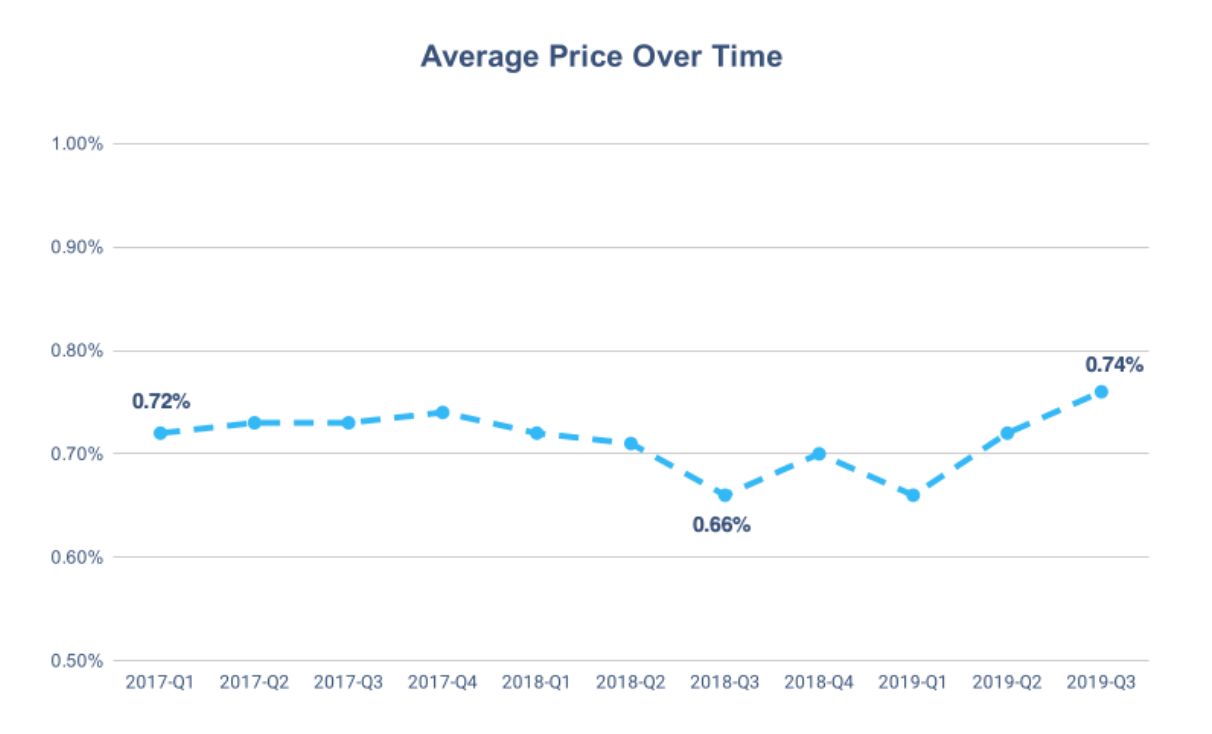

We’re now seeing the full quarter impact of the price rises we rolled out in June — as a reminder, these were partially due to investing in our hosting and infrastructure.

With these investments in our reliability and scalability now in place, we can support volume growth in the future. It will help us continue to work on lowering our prices in the future.

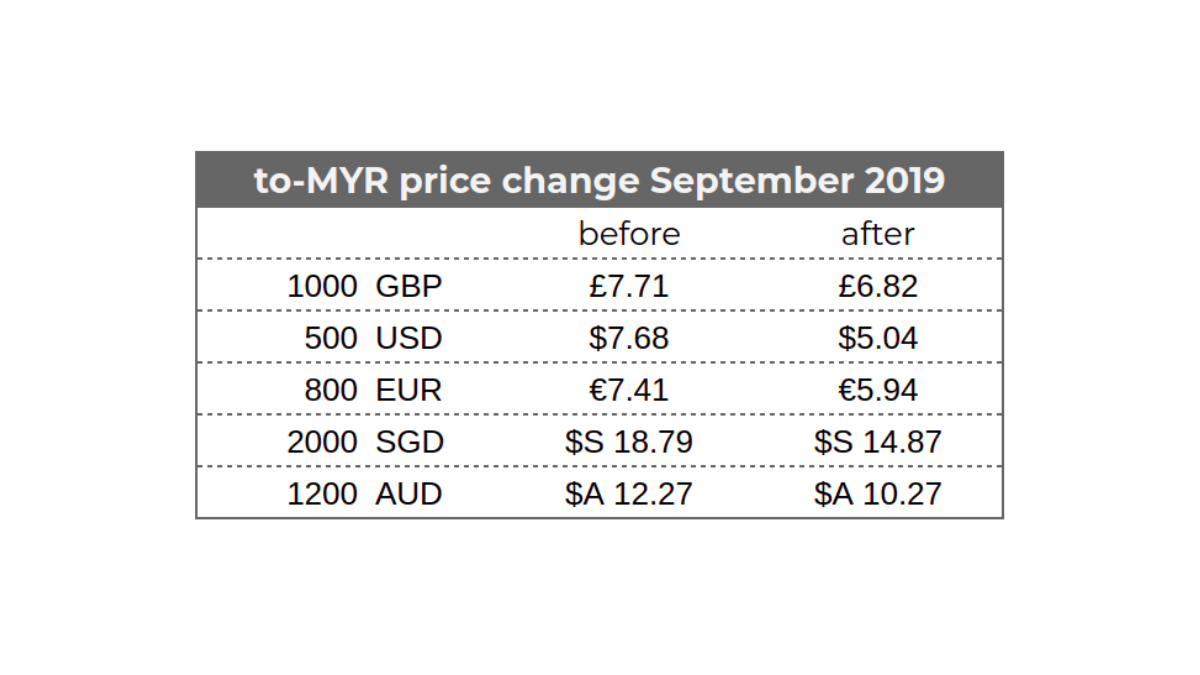

For example, although our average price shows an increase this quarter, we managed to lower prices for money sent to Malaysia and the Philippines as our volumes have increased.

We’ve continued to roll out our Wise debit card around the world.

In August, Aussie and Kiwi users were at last able to get their own card; for themselves as well as for their businesses. We conducted some independent research that found Australians lose over A$2.14 billion a year by using their local cards overseas. We decided to bring attention to the issue with an installation in Sydney.

The Wise card is 11x cheaper than the local Aussie competition and we’re already seeing thousands of cards in use on six continents.

Over 20,000 people in Argentina, Costa Rica, Uruguay, Tanzania and West Africa asked us to bring Wise to them.

So this quarter, we introduced money transfers from Argentina, and to Costa Rica, Uruguay, and Tanzania. On top of that, you can now send money to the West African franc (XOF). Welcome all to the Wise community!

If a currency you need isn’t on Wise yet, please let us know. We’ll make sure you’re the first to know when we add it.

We’ve continued to make our product more convenient for users in Brazil. We’re testing the ability for Brazilians to pay for education with Wise. And we’ve increased the limits for sending money from Brazil from 30,000 BRL to 1 million BRL per transfer. Over 400 of you have already taken advantage of these new features.

In Australia, we automated identity verification during account setup for many of our mobile users. Here, customers would previously have needed to upload documents that prove their identity. Now we run checks in the background, making onboarding instant for 40% of Android users, up from 26%.

Singaporeans also now get instant verification on their mobile. This has been live on desktop for a while through an integration with a government database. It’s now live on Android and iOs too. This means 17% of Android users and 24% of iOs users in Singapore get verified instantly.

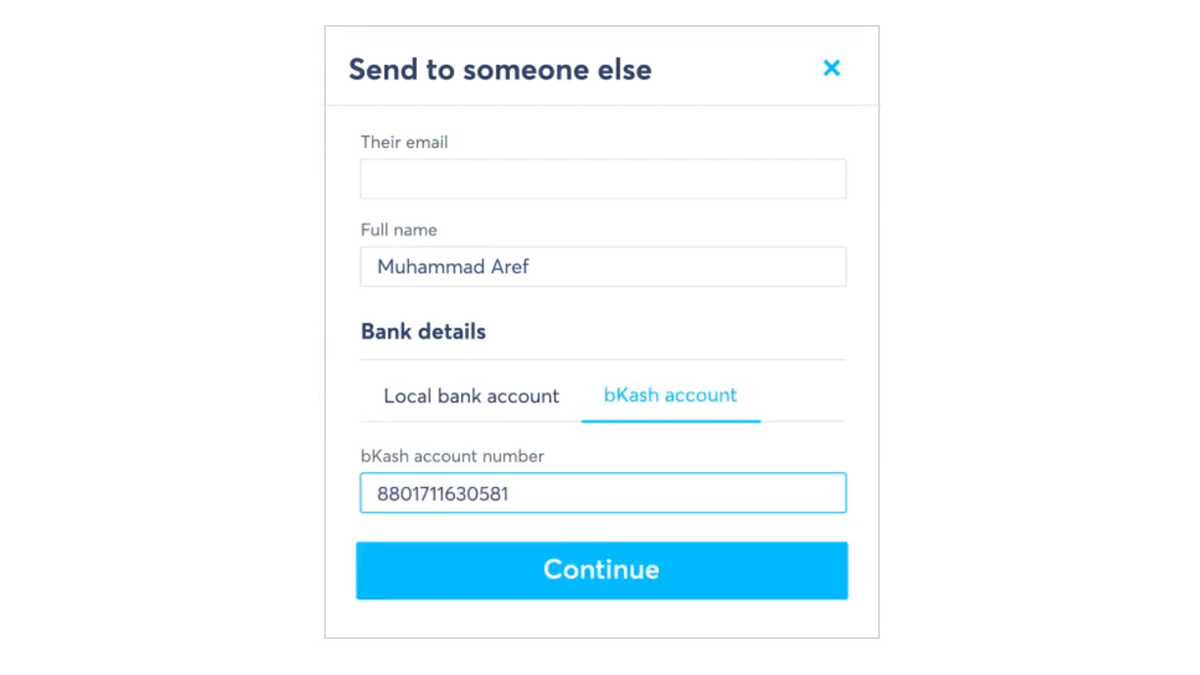

For users in Asia, we’ve improved convenience. We made a big change for users sending money to Bangladesh — they can now send money to the popular mobile wallet bKash. Over 15% of our Bengali customers have taken advantage of this feature already.

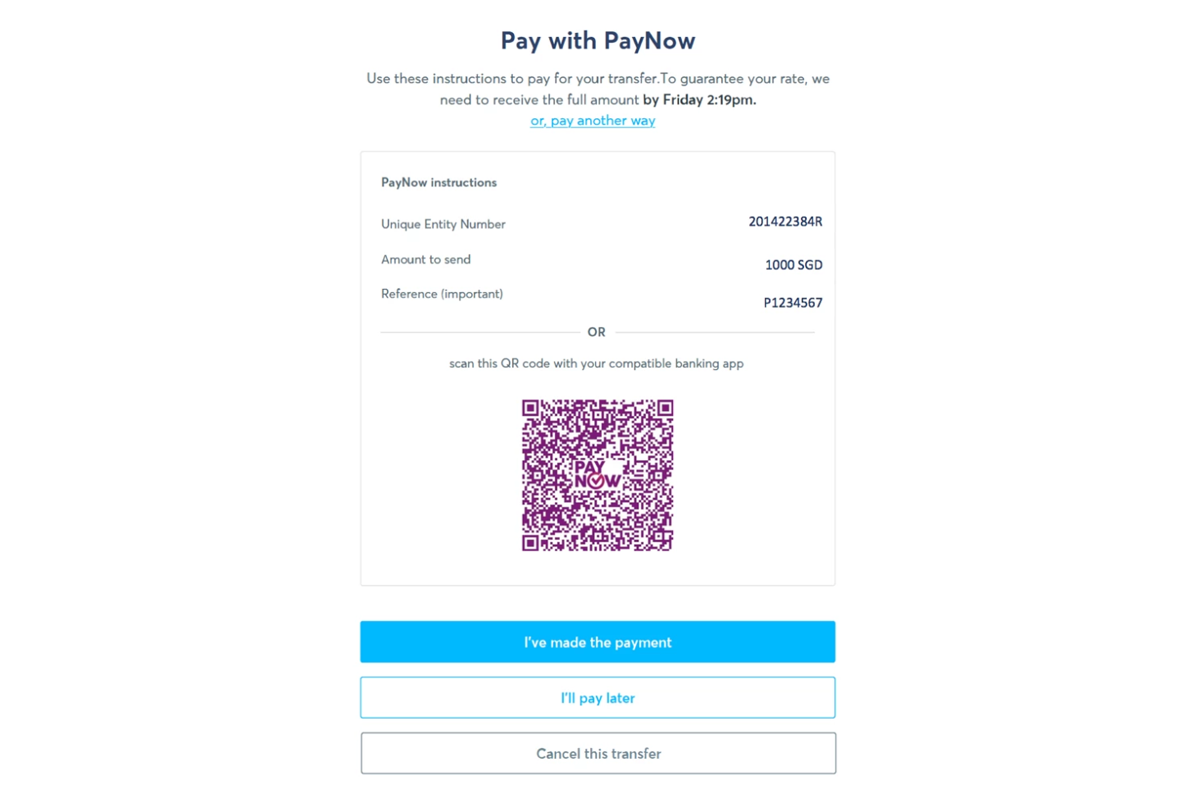

In Singapore, users can now pay for their transfers with a dynamic QR code, which means you no longer have to enter the amount or your membership number. This change is already making over 8,000 transfers per month instant to fund.

Starting from September, we might now ask you to enter your password or authenticate with biometrics when you send money to someone new, or send money from your Wise balances. This is called stronger customer authentication.

We’ve been working hard on improving the speed at which you can talk to one of our support agents. Last quarter alone, we had over 800,000 interactions with our customers. 52% of those issues were resolved within a day. It is not amazing yet, but a 20% improvement on last quarter. We know we still have a long way to go to meet your and our expectations.

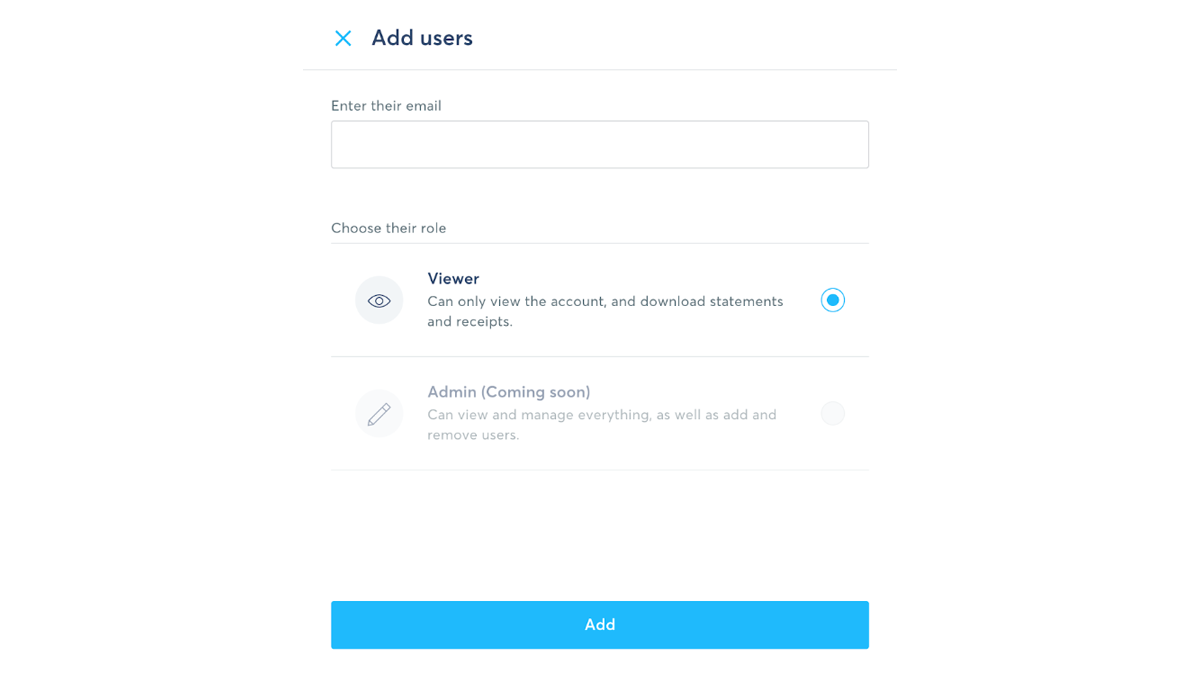

Multi-User Access (MUA) has long been one of the most requested Business features on Wise. We continue to make progress towards rolling that out for our Business users; the first step this quarter was a limited release in beta of “View” only MUA.

To follow the progress the team is making on MUA, take a look at their status page.

For business customers down under, we integrated with the Australian Business Registry API. This allows for a faster business verification experience thanks to automatic lookup of a user’s business details. More than 75% of new business users in Australia are already getting this experience.

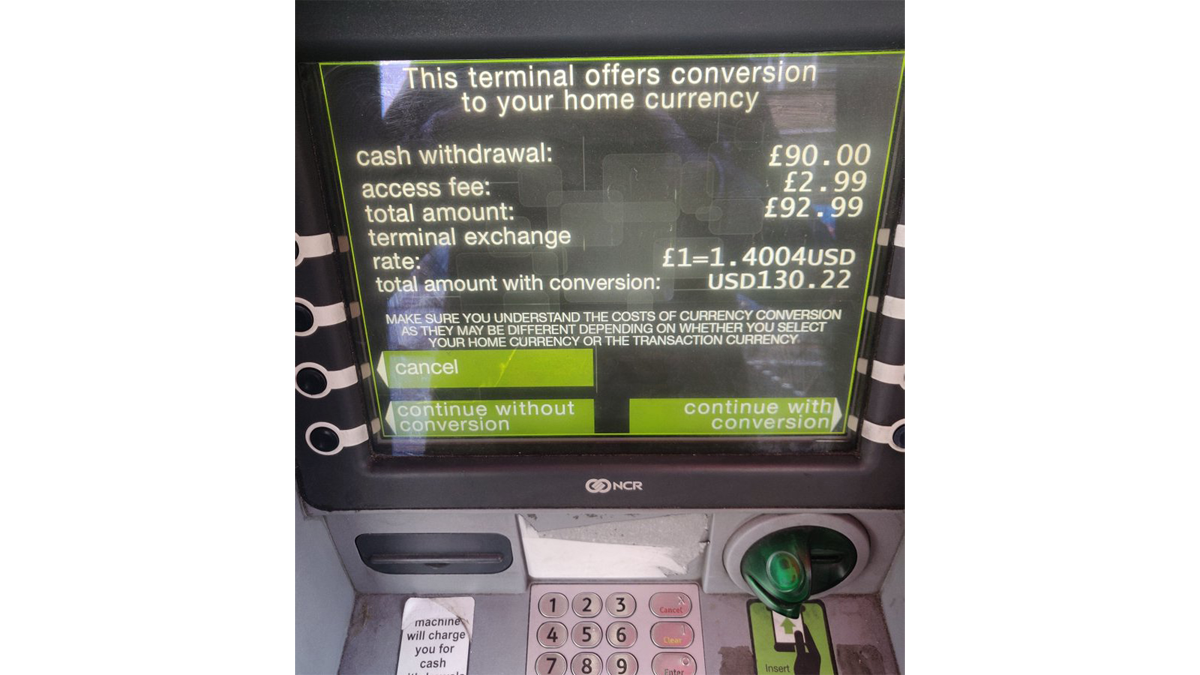

If you’ve ever used a card abroad, you’re probably familiar with getting asked if you want to pay in your home currency or the local currency. This is known as “Dynamic Currency Conversion” (DCC) and it’s usually a huge rip off. Our analysis shows the markup can be as much as 8%.

We can't block DCC for Wise card users. But we can make sure cardholders only make this mistake once. Over 10,000 customers a month were falling foul of DCC multiple times. So we built a warning that should help you avoid getting ripped off this way repeatedly.

Now, when you use your card abroad and select DCC you'll get a push notification that lets you know what’s happened, and links to an article explaining more about the practice.

The Australian Competition and Consumer Commission (ACCC) has been conducting an investigation into markups on foreign exchange. We’ve been providing input, and the ACCC released their report this quarter.

It found that banks and foreign exchange providers should have to inform customers about the total price of a transfer. The report stops short of giving clear recommendations about how to do that, so we’re staying closely involved through consultations and written responses.

It will take up to 12 months for any changes to roll out across Australia. But we’re working to make sure all Aussies know exactly what they’re paying for when it comes to moving money internationally.

While we aim for transparency in financial services, we also need to be transparent with our community. It’s one of the reasons we publish these mission updates. And it’s also the reason we shared the details of our Annual Report in September.

The headline numbers are that we’re now a community of over 6 million people moving £4 billion every month. That’s a saving of £1 billion a year compared to making these transactions with your bank. In the summer of 2018, you were 3 million people, transferring £2 billion monthly. A year later, and our revolution is now twice as strong.

It was also the third consecutive financial year in which Wise posted a profit, with a 53% growth in annual revenue to £179 million. For us, it’s important that we grow sustainably, and posting a profit means you can know that Wise is here for the long-term.

We come to work every day to improve and expand Wise, so it’s powerful to know that we’re funded by you. And we’ll keep working to bring Wise to others like you, all over the world.

The team helping build money without borders has grown to over 1800 people across 12 countries. We’ve invested in growing the team by over 400 so far this year, including our biggest ever intake of 30 engineering interns.

If you want to help us make our mission a reality, we have over 200 open roles right now including Global Head of Analytics, various exciting Product Manager opportunities and our first HR People Partner. Check out https://wise.com/jobs/ to find out more.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

The “Going Global” Challenge In today’s post-pandemic world where employees can work from anywhere and companies are more frequently hiring beyond their...

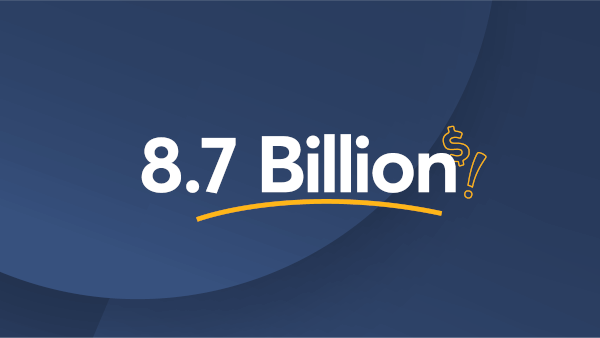

Hidden exchange rate markups estimated to cost Americans $8.7 billion in 2019 Consumers and businesses lose billions every year when they send and spend money...

Our mission has become irreversible, the company financially independent, and adoption continues to accelerate. Thank you - Wise customers - for...

To the Wise community When my co-founder and I launched Wise 7 years ago, we set out to irreversibly fix how money doesn’t work across...

You have made Wise possible. You keep our lights on, so that we can make money move faster and cheaper for you. This is our Q2 report to you.

Money is information. Using, storing and moving money should be as cheap and instant as exchanging information. As cheap as sending an email. And certainly it...