Pay overseas invoices without breaking the bank.

Forget traditional money transfers. Handle one-off invoices, recurring payments, and mass payouts in over 70 countries with an exchange rate your bank and PayPal can’t offer.

Pay vendors and bills for less.

No inflated rates and high transfer fees here.

Unlike banks and services like PayPal, Wise uses the real exchange rate and charges super low transfer fees — saving businesses 3M GBP each month.

The more you send, the more you save.

Our fee gets cheaper when you send amounts above 20,000 GBP (or equivalent in your currency). You’ll get a cheaper fee whether you send a one-off large transfer or multiple transfers over a month.

- Discount is based on your monthly volume

- Valid on single and multiple transfers

Pay one or 1,000 invoices in record time.

Use the batch payments tool to create and send up to 1,000 payments with just one transfer.

Simply upload a spreadsheet with the invoice and currency info, and our smart tech will do the rest. 50% of payments are paid out within an hour.

Get extra help from your team.

Add members of your team to your account to help you set up payments or handle accounting.

You also can schedule invoice payments for a future date to get ahead of your to-do list.

Pay USD invoices to vendors outside the US.

Send USD to USD-denominated bank accounts located in countries outside the US, including China.

Set up a USD transfer like you normally would. Just make sure you update the country. It may cost a bit more than a regular transfer.

Automate payouts with our API.

Large and enterprise-level businesses making high volumes of payouts can work with our team to create a solution to help them scale.

The Wise API gives businesses access to the low fees, speedy transfers, and smart tech that powers Wise Business transfers.

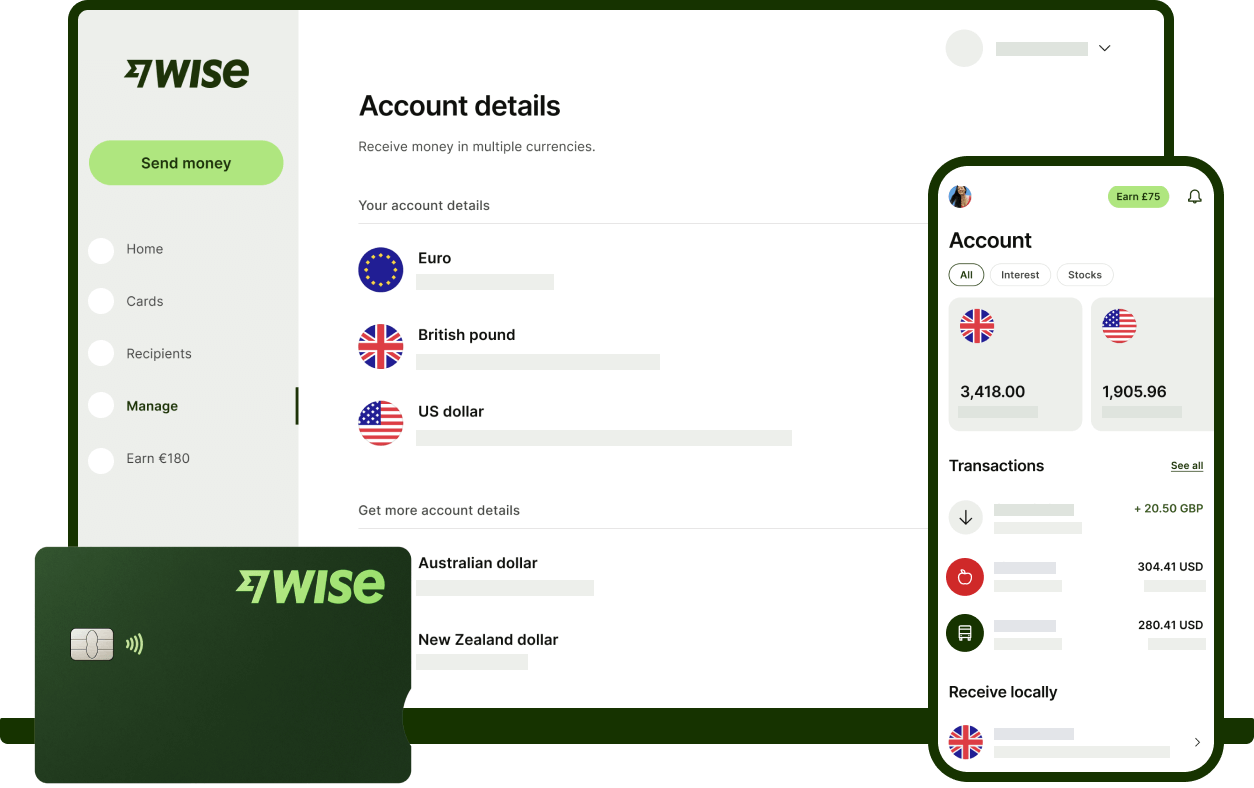

Get a multi-currency account to better prep for future payments.

A Wise Business account lets you hold money in 55+ currencies.

So if you see a great exchange rate, take advantage and convert your money for future payments.