Send money to India from abroad

- Low fees — fees get cheaper the more you send

- Lightning fast — money typically arrives in seconds

- Perfectly predictable — lock in an exchange rate for up to 48 hours

Bank transfer fee

0 EUR

Our fee

177.34 EUR

Total included fees (0.59%)

177.34 EUR

- You could save up to 3,919.16 EUR

Should arrive by Monday

Send money to India from abroad

- Low fees — fees get cheaper the more you send

- Lightning fast — money typically arrives in seconds

- Perfectly predictable — lock in an exchange rate for up to 48 hours

Bank transfer fee

0 EUR

Our fee

177.34 EUR

Total included fees (0.59%)

177.34 EUR

- You could save up to 3,919.16 EUR

Should arrive by Monday

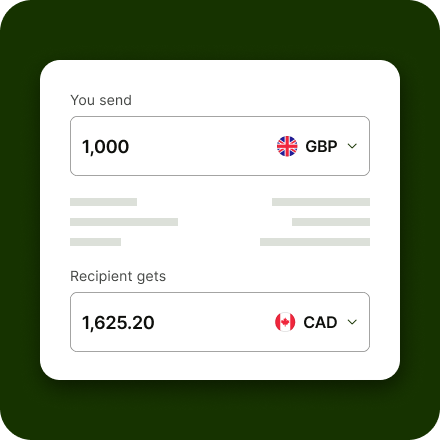

Save on exchange rate markups

The cost of your transfer comes from the fee and the exchange rate. Many high street banks offer “no fee”, while hiding a markup in the exchange rate, making you pay more.

At Wise, we’ll never do that. We only use the mid-market exchange rate, and show our fees upfront. This table compares the fees you’d really pay when sending money with the most popular banks and providers, or with us.

How do we select providers and collect this data?| Sending 1,000 USD with | Recipient gets(Total after fees) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 86,015.05 INR | ||||||||||

Transfer fee 7.33 USD Exchange rate(1 USD INR) 86.6502 Exchange rate markup 44.07 USD Cost of transfer 51.40 USD | |||||||||||

| 83,619.02 INR- 2,396.03 INR | ||||||||||

Transfer fee 5 USD Exchange rate(1 USD INR) 84.0392 Exchange rate markup 72.87 USD Cost of transfer 77.87 USD | |||||||||||

How to send money to India from abroad in 3 easy steps

Enter amount to send in EUR.

Pay in EUR with your debit card or credit card, or send the money from your online banking.

Choose recipient in India.

Select who you want to send money to and which pay-out method to use.

Send EUR, receive INR.

The recipient gets money in INR directly from Wise’s local bank account.

How much does it cost to transfer money to India from abroad?

Pay a small, flat fee and percentage

To send money in USD to India from abroad, you pay a small, flat fee of 7.17 USD + 0.46% of the amount that's converted (you'll always see the total cost upfront).

Fee depends on your chosen transfer type

Some transfer types have different fees which are usually tiny.

No hidden fees

No big fees, hidden or otherwise. So it's cheaper than what you're used to.

How long will a money transfer to India from abroad take?

On many popular routes, Wise can send your money within one day, as a same day transfer, or even an instant money transfer.

Sometimes, different payment methods or routine checks may affect the transfer delivery time. We’ll always keep you updated, and you can track each step in your account.

Your transfer route

Should arrive

by MondayBest ways to send money to India from abroad

Bank Transfer

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option.Trustly

Trustly is an online bank payment method. With Trustly, you can send money to Wise without leaving our site or app. It's a simple and convenient way to pay in EUR, PLN, SEK, and DKK.

What you’ll need for your online money transfer to India from abroad

Register for free.

Sign up online or in our app for free. All you need is an email address, or a Google or Facebook account.

Choose an amount to send.

Tell us how much you want to send. We’ll show you our fees upfront, and tell you when your money should arrive.

Add recipient’s bank details.

Fill in the details of your recipient’s bank account.

Verify your identity.

For some currencies, or for large transfers, we need a photo of your ID. This helps us keep your money safe.

Pay for your transfer.

Send your money with a bank transfer, or a debit or credit card.

That’s it.

We’ll handle the rest. You can track your transfer in your account, and we'll tell your recipient it's coming.

Protecting you and your money

Safeguarded with leading banks

We hold your money with established financial institutions, so it's separate from our own accounts and in our normal course of business not accessible to our partners. Read more here.

Extra-secure transactions

We use 2-factor authentication to protect your account and transactions. That means you — and only you — can get to your money.

Data protection

We’re committed to keeping your personal data safe, and we’re transparent in how we collect, process, and store it.

Dedicated anti-fraud team

We work round the clock to keep your account and money protected from even the most sophisticated fraud.

Send money from abroad with the Wise app

Looking for an app to send money from abroad? Sending money is easy with Wise app.

- Cheaper transfers abroad - free from hidden fees and exchange rate markups.

- Check exchange rates - see on the app how exchange rates have changed over time.

- Repeat your previous transfers - save the details, and make your monthly payments easier.

Wise works nearly everywhere

See why customers choose Wise for their international money transfers

It’s your money. You can trust us to get it where it needs to be, but don’t take our word for it. Read our reviews at Trustpilot.com.