Pro-rata calculator

How to use the pro-rata calculator:

Use the part-time wage calculator to work out your salary or take-home once National Insurance and Income tax deductions have been made:

Enter the full-time annual salary, before any taxes and deductions have been taken out.

Enter the number of weekly hours that are considered full-time.

Enter the pro-rata number of weekly hours or weekly hours worked.

The pro-rata calculator will work out your take-home pay, pro-rata salary, Tax Free Allowance, Taxable Income, National Insurance and Income Tax.

This calculator is intended only as a guide and uses normal UK tax and NI information to calculate the net salary of an employed person. Tax is complex, and your personal circumstances might mean your take-home pay is different. Seek professional advice if you want to learn more.

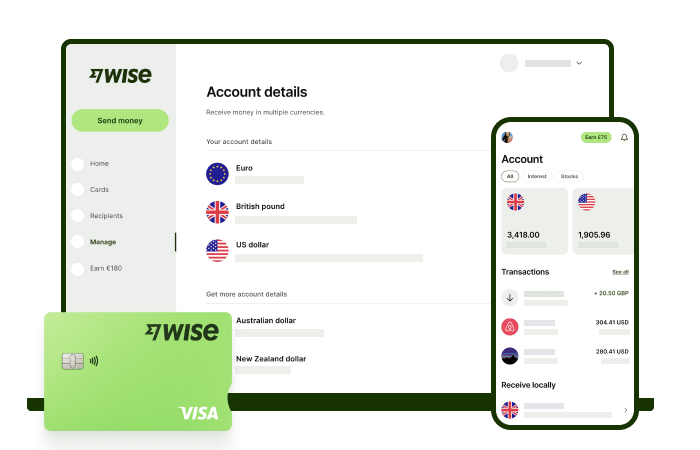

What is the Wise foreign currency account?

A Wise account is the perfect alternative to having a bank account abroad.

If you need to send or receive payments from overseas, Wise can help. Hold 40+ currencies, and switch between them when you need to, using the Wise app.

There are no annual fees, and currency conversion uses the mid-market rate with no markup - just a low fee per transaction. You’ll get a linked debit card for easy spending, and your own bank details for fee-free payments from the UK, US, Euro area, Poland, Australia and New Zealand.

Get a Wise multi-currency account and get paid with your own bank details.

How much tax will I pay on my take-home?

Under the UK’s PAYE (Pay as you earn) system, employers deduct tax and National Insurance (NI) contributions before they pay you.

Most people can earn a certain amount tax free: in 2020/2021, this is set at £12,500. Tax is then calculated according to the amount you earn, with a 20% tax rate for income up to £37,500, and 40% tax on amounts above this, to £150,000. These figures are adjusted annually, and may vary across different regions of the UK.

Starting with your gross salary, your employer will calculate your tax and NI liabilities, taking into account your tax-free allowance and the tax bands your wage falls into.

More salary calculators

Take-home pay calculator

The take-home pay calculator will tell you your monthly salary or annual earnings after normal UK tax and National Insurance contributions. Get this simple take-home pay calculator here.

Hourly Wage Calculator

Calculate your salary or take-home pay from your hourly rate, using this simple and free excel based hourly wage calculator

Self-employed income tax calculator

If you’re self-employed in the UK, you can work out your profit after tax, and what you need to pay in Income Tax and National Insurance, with this easy to use self-employed income tax calculator.

Wise is your easy, cheap alternative to a bank account abroad

Open online in just a few steps, with no monthly fees - just simple currency services using the real exchange rate.