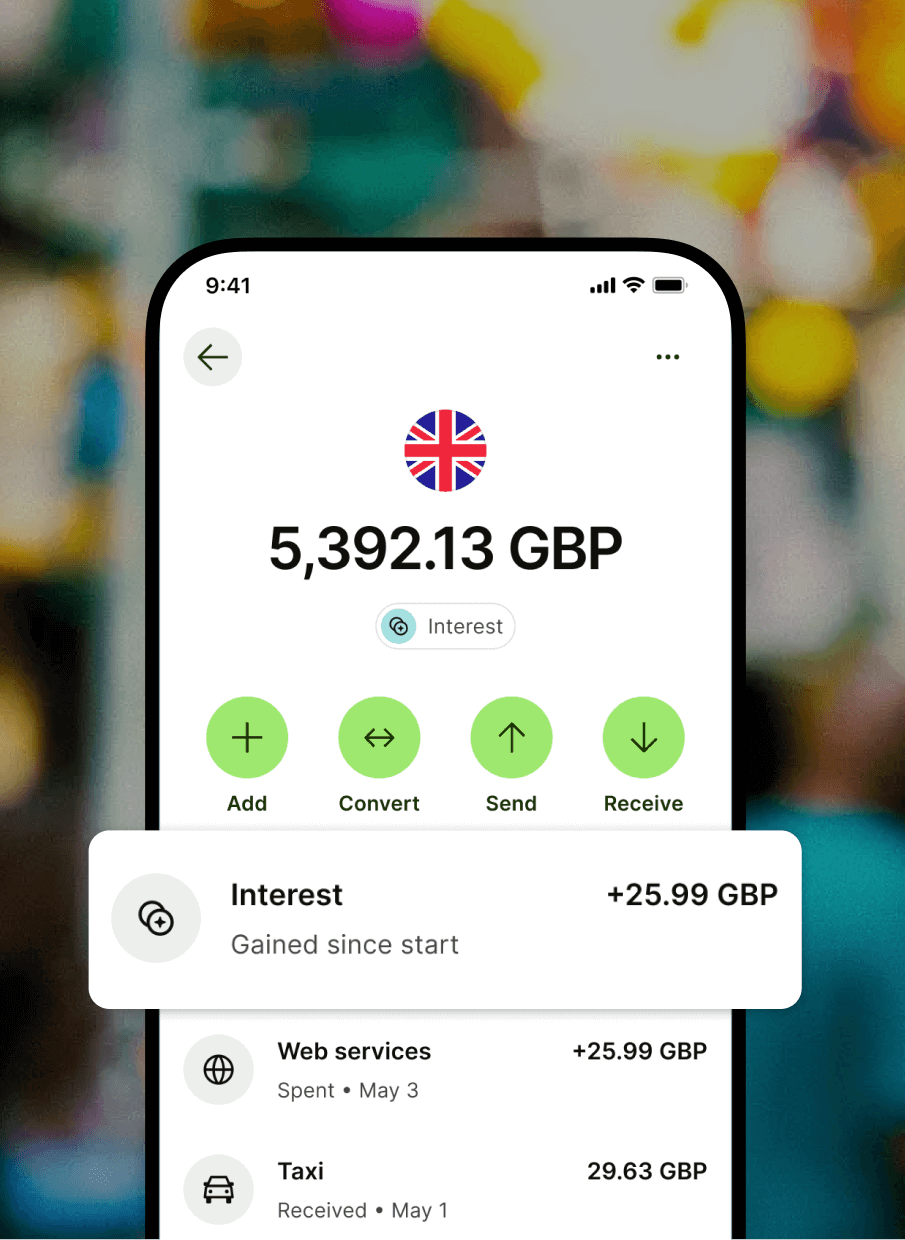

Earn a return while you grow your business

Earn returns on GBP, USD and EUR by opening a Wise account and investing in a fund that holds government-guaranteed assets. Spend any time, all while you grow. Capital at risk.

.jpg)

*Growth is not guaranteed and your money is at risk if governments default or interest rates go negative. Variable rates are based on 7 day performance as of 12/02/2025. See the past performance of each fund below.

Interest is offered in partnership with BlackRock and through Wise Assets. The funds aim to maximise current income through a portfolio of high quality short-term money market instruments. You may have to pay tax on your earnings — for example, capital gains tax.

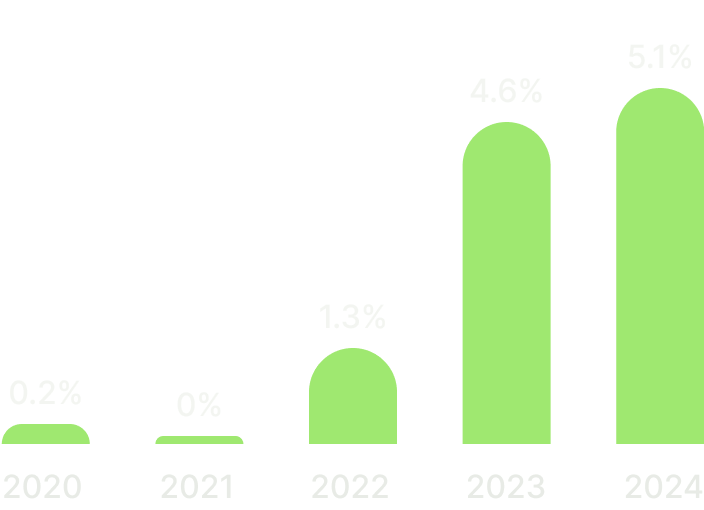

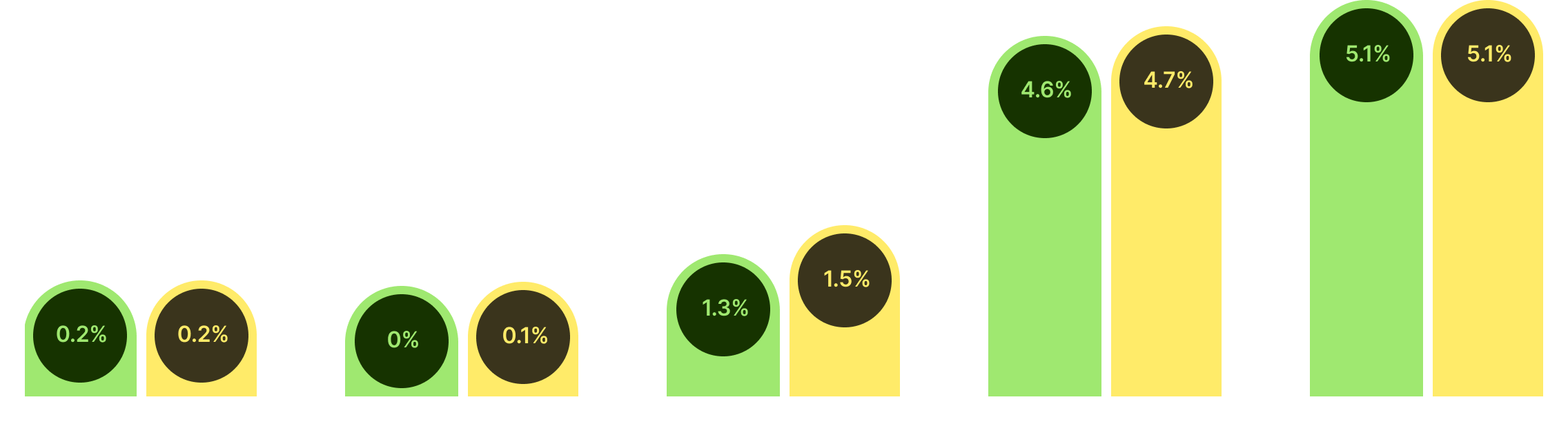

GBP fund tracks the Bank of England rate

- Fund Rate

The graph shows past performance of the BlackRock ICS Sterling Government Liquidity Fund. The fund has returned an 0.93% annual average over the last 5 years, excluding Wise fees. The current rates do not guarantee future growth. For more on the fund's past performance, visit the BlackRock fund page.