5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a crucial indicator of a company's activity and health. This article delves into what financial turnover is, the different types of turnover, and what it means for businesses striving for sustained international growth and success.

| In this article: |

|---|

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of financial or business advice.

Financial turnover is an important indicator of business size and market activity. While it provides insight into sales performance, it does not directly indicate profitability as it does not account for costs and expenses. In other words, a business can have high turnover but still operate at a loss if costs are disproportionately high.

Revenue Indicator: Financial turnover, also known as gross revenue or income, represents the total sales made by a business over a specific time period. It serves as a key indicator of a company's top-line performance and the market demand for its products or services.

Financial Analysis: Turnover is crucial for financial analysis as it helps assess profitability, efficiency, and growth. By comparing turnover to gross and net profit, businesses can evaluate profitability and identify areas for improvement. It also plays a key role in calculating efficiency metrics like inventory and accounts receivable turnover. Over time, this helps businesses track growth and market position.

Total revenue turnover refers to gross revenue or total sales. It represents the total income generated by a company through its core business operations before any deductions or expenses are taken into account.

The basic formula for total revenue turnover is: Total Revenue Turnover = Number of Units Sold × Price per Unit For service-based businesses, it might be: Total Revenue Turnover = Number of Services Provided × Price per Service

In some jurisdictions, total revenue turnover determines various regulatory requirements, such as VAT registration in the UK (threshold of £90,000 as of 2024).

| When expanding internationally, tracking this metric for each market can help your business assess market performance, identify growth opportunities, or allocate resources efficiently. |

|---|

Working capital turnover is a financial ratio that measures how efficiently a company uses its working capital to generate sales or revenue.

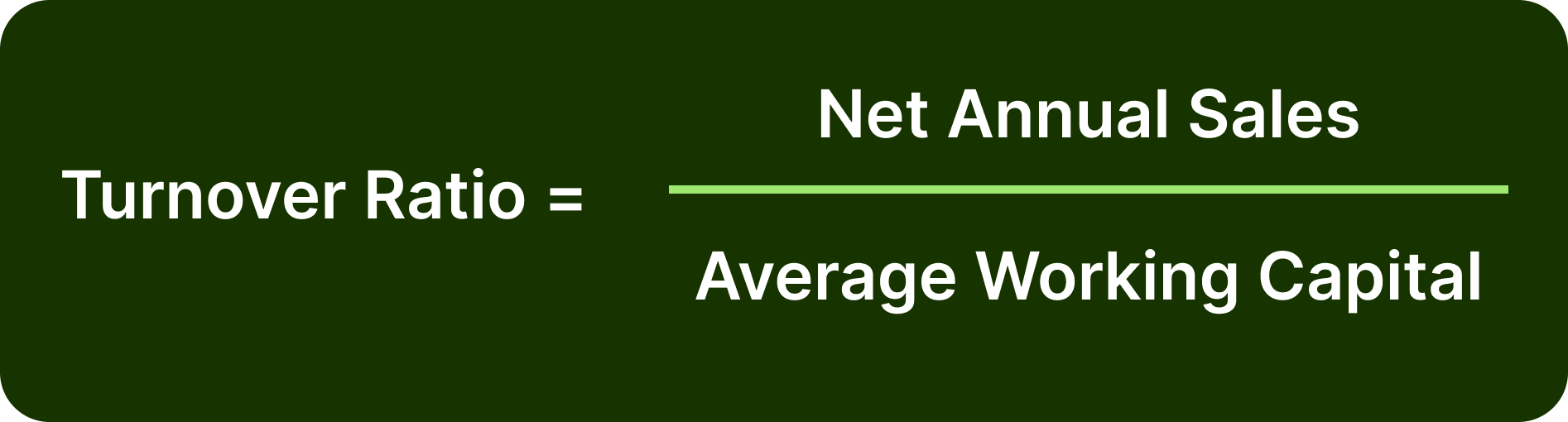

This is the formula to calculate the working capital turnover:

Net Annual Sales = the company's total revenue for the year

Average Working Capital = typically calculated as (Beginning Working Capital + Ending Working Capital) / 2

For overseas expansion, a high working capital turnover ratio can indicate efficient use of resources, ability to fund growth without additional capital, or potential for successful scaling

Inventory turnover measures how many times a company sells and replaces its inventory within a set period, usually a year.

It's calculated using the formula:

COGS = Cost of Goods Sold

Average Inventory = (Beginning Inventory + Ending Inventory) / 2

| When expanding internationally, this metric can provide insight into market-specific demand patterns and customer behaviours, and help optimise inventory levels across different countries to balance stock availability with storage costs. |

|---|

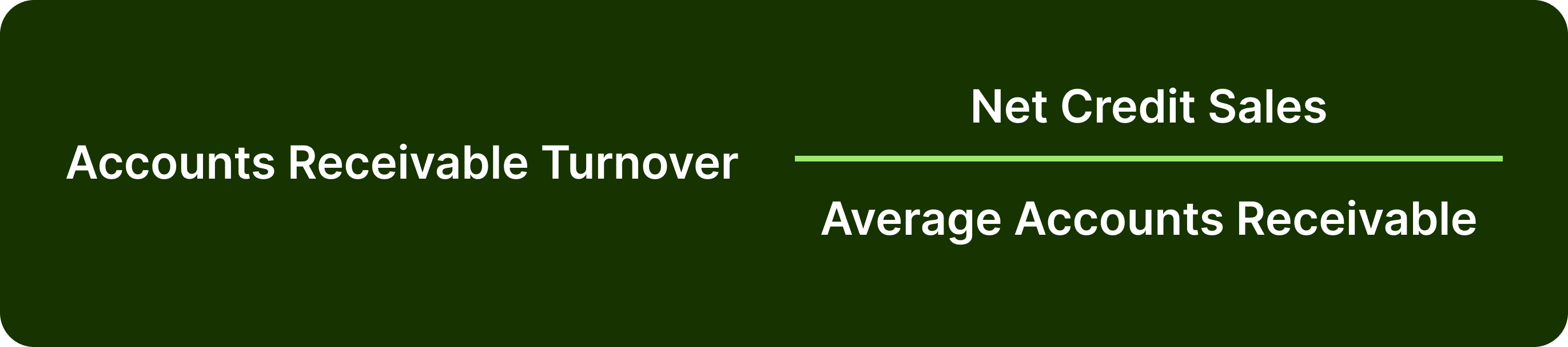

This ratio measures how efficiently a company collects cash from its credit sales, calculated by:

Net Credit Sales = Total sales on credit (excluding cash sales)

Average Accounts Receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) / 2

| When expanding globally, this metric becomes critical as it reflects cash flow efficiency, helps manage credit policies across different markets, and identifies potential collection issues in new territories. |

|---|

This is an example of a Singaporean company expanding its services to the UK.

Their current revenue turnover is:

Since the two markets are in different countries with different currencies, it’s important to convert one currency into the other so you can easily compare the two.

According to today's Wise mid-market rate, the exchange rate is S$1 = £0.58 (rates change daily, so the figure may differ). Therefore, S$500,000 would be £290,000.

Now we can compare more accurately to understand the impact:

What does this mean?

Right now, Singapore is generating more revenue (£290,000) than the UK (£200,000).

But this is just the first year for the UK, so it could grow in the future.

This is a measure of how efficiently your business is using its working capital (the money you have for day-to-day operations). A higher number is better because it means you’re generating more sales for every dollar of working capital you use.

How do you interpret these numbers?

| Singapore is using its capital more efficiently than the UK. The UK's lower ratio of 4.2 means you might need to better manage your working capital (e.g., reduce expenses, better cash flow management) to achieve stronger results. |

|---|

This measures how quickly your customers are paying you. A higher number is better because it means you’re collecting payments faster, which is good for cash flow.

| If you're waiting too long for payments in the UK, this could hurt your cash flow. Improving your collection process in the UK (e.g., asking for payments sooner or offering discounts for early payments) could speed this up and improve your cash flow. |

|---|

When calculating financial business turnover, there are several common mistakes companies should be aware of to ensure accurate financial reporting and analysis.

Misunderstanding Turnover Definition

One of the most fundamental mistakes is confusing turnover with profit. Turnover represents the total sales or revenue generated by a business over a specific period, not the earnings after expenses.

Incorrect Time Period

Failing to define a consistent time period for turnover calculation can lead to inaccurate comparisons and analysis. Turnover should be measured over a specific period, such as a tax year or fiscal quarter.

Excluding Relevant Sales

Some businesses may inadvertently exclude certain types of sales from their turnover calculations. It's important to include all revenue sources that fall within the defined turnover period.

Inconsistent Record-Keeping

Poor or inconsistent record-keeping can lead to errors in turnover calculations. Maintaining accurate and up-to-date financial records is crucial for correct turnover reporting.

Ignoring Seasonal Fluctuations

For businesses with significant seasonal variations, calculating turnover based on a short period may not provide an accurate representation of the overall financial performance. It's important to consider these fluctuations when analysing turnover.

For businesses looking to scale overseas, the Wise Business account stands out as a comprehensive solution to simplify global operations. With the ability to manage over 40 currencies within a single account, companies can effortlessly engage in cross-border transactions without the hassle of multiple accounts or high conversion fees.

The Wise Business account offers more than 23 account details, enabling businesses to receive payments like a local in different countries. Further, the platform allows users to create invoices with ease and seamlessly syncs with accounting software to streamline financial management. These features make the business account an invaluable tool for any organisation aiming to expand its reach and optimise its international financial strategy.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

December kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain and get ready for the holiday season....

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...

In an increasingly interconnected global economy, small businesses in the United Kingdom (UK) have more opportunities than ever to expand through import and...

As a small business owner, ensuring timely and accurate payments is crucial for your success and sustainability as you grow and scale your business. Getting...