5 Ways to Stand Out and Boost Black Friday Sales

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

December kicks off the end of year shopping period, with huge uplifts in on and offline sales as people grab a bargain and get ready for the holiday season. Over the the next couple of weekends, online retail traffic can double - making it a huge opportunity if you’re in e-commerce.

If you're selling online to customers abroad, you need ways to get paid quickly and efficiently, without hidden fees or exchange rate markups, Wise Business can help.

This guide walks through some great ways to get paid over the holiday season, including taking multiple currency payments, using payment platforms and Buy Now, Pay Later services. Let’s dive right in.

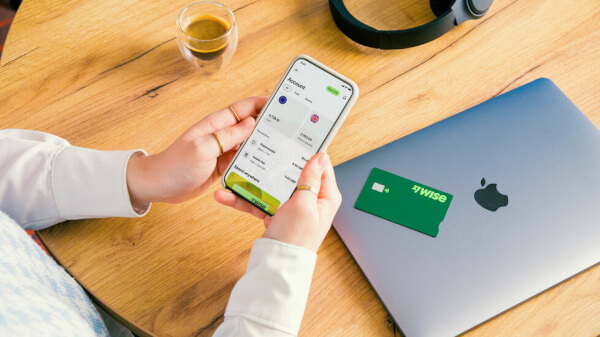

Managing multiple currencies with Wise

The end of year sees a surge in online retail traffic - which is likely to bring new customers to your site looking for a great deal. With new customers in particular, you need to make it as easy as possible for the customer to pay, to land that first sale and create some brand loyalty. Here, offering multiple payment methods such as debit and credit cards, direct bank transfers, or even payment gateways like Stripe and PayPal can allow customers to choose their preferred method and be more likely to shop with your business.

Receiving some payment types may mean that there are fees to pay - but offering the broadest possible range of payment methods will increase your appeal and reduce the number of carts abandoned at checkout.

E-commerce allows you to connect to customers globally. By allowing customers to pay in their preferred currency, you’ll increase trust as the customer knows they won’t be hit with high conversion costs when they purchase.

However, if you’re offering multi-currency payments it’s crucial that you choose the right provider to withdraw these foreign currency earnings, so you're not losing your hard-earned money on high conversion costs.

Check out Wise Business which offers a powerful multi-currency account you can use to accept payments in different currencies. This can help you attract global shoppers and reduce payment friction - and because Wise uses the mid-market exchange rate for currency conversion, with low fees, you’ll know you’re not losing out on high conversion costs either. Receive payments to a Wise Business account from PSPs and marketplaces, or direct from customers using a bank transfer or local payment method, in 9+ global currencies, and you’ll be able to hold, exchange, send or spend your money conveniently. We’ll cover a little more on how Wise Business can help you grow your business globally, later.

E-commerce platforms like Amazon have made it possible to sell to customers anywhere in the world. However, if you sell on Amazon and get paid in multiple currencies, you may encounter hefty conversion fees which can eat into your bottom line. Here again, Wise Business can be a great tool to keep more of your money when connecting with overseas customers.

Wise Business can be integrated with major e-commerce platforms like Shopify, WooCommerce, Amazon or Etsy. This makes it easy for businesses to receive payments directly into their Wise Business account, simplifying the financial management of a busy sales seasons.

With Wise Business, you can withdraw your earnings from most platforms directly into your account in 9+ currencies without paying a penny - all you need to do is open account details in your chosen currency and link your account to your platform seller's account to get paid seamlessly. That’s easy for the customer, and for you too.

November kicks off a very busy time for retail - and customers may also be looking to maximise the bargain hunting opportunity without paying for everything upfront and immediately. Taking customer credit card payments is one solution - and offering Buy Now, Pay Later options such as Afterpay, Klarna, and Affirm can also allow customers to make purchases and pay over time.

Buy Now, Pay Later services can encourage higher cart values, as customers are more likely to buy expensive items when they can spread the cost over time. This can increase your reach, and start to build your customer base in new markets.

Holiday season isn’t just about retail sales direct to consumers - wholesale and B2B e-commerce businesses often also get involved, offering seasonal discounts, and using this as a hook to communicate with their client base.

Create a free, professional invoice in your Wise Business account

If you get paid by bank transfer using customer invoices, you might want to check out Wise Business' free invoicing tool. Create and send invoices in multiple currencies, making it easier to get paid by clients globally during the busy sale periods and beyond. You’ll be able to receive your money right to your Wise account, to hold, send, spend or exchange as you wish. Easy.

Wise Business offers all you need to manage your day to day business finances across 40+ currencies, with no monthly subscription to pay.

Over a busy sales period like holidays and the end of the calendar year, you need efficient and low cost ways to receive payments, including foreign currency payments when trading with customers overseas. You’ve got plenty of options, from taking customer card payments, using payment platforms and PSPs, and offering Buy Now, Pay Later for convenience.

No matter which payment options suit your specific business, getting an account with Wise Business could be a smart move if you need to pay or get paid in foreign currencies. You’ll get all you need to manage your business finances, with international functions, low cost payments, and mid-market exchange rates, so you can connect with customers around the world without excessive currency costs.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Black Friday is the day after Thanksgiving, falling on Friday 29th November in 2024. It’s known for being a perfect time for snagging a bargain, opening the...

The term "turnover" is used often in the world of business, but its implications vary significantly depending on the context. At its core, turnover is a...

Wise is a financial technology company focused on global money transfers that offers two different types of accounts: a personal account and a business...

In today's fast-evolving digital landscape, e-commerce is quickly transforming the ways consumers shop and how businesses operate worldwide. DHL’s E-Commerce...

In an increasingly interconnected global economy, small businesses in the United Kingdom (UK) have more opportunities than ever to expand through import and...

As a small business owner, ensuring timely and accurate payments is crucial for your success and sustainability as you grow and scale your business. Getting...