What is Direct Debit money transfer?

Whether you call it a direct debit or an EFT, direct debit money transfers are often one of the cheapest ways to make a Wise international payment. It’s convenient to arrange a direct debit to Wise - you can often get set up online or in your bank’s mobile app, so you don’t even need to leave home.

You can make a Wise direct debit money transfer of up to 9,500 CAD in 24 hours from a personal account. There’s also a limit of 30,000 CAD a week. You can send direct debit payments from a business bank account, too, as long as you have a Wise Business account.

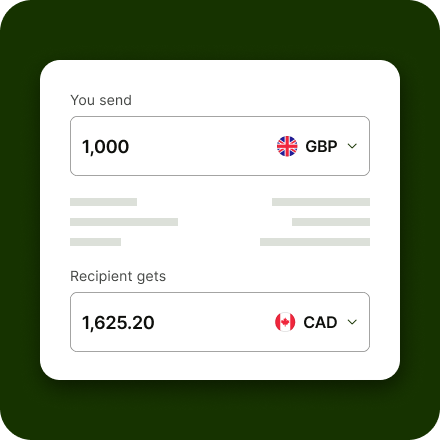

When you set up a Wise money transfer and pay by direct debit, the exchange rate is guaranteed as soon as you authorize payment to Wise. That means there are no surprises if the rates change while your direct debit is winging its way to Wise - you’ll know exactly how much your transfer will cost you, and what rate you’re getting, straight away.

Learn more about using direct debit transfers.