Understanding the meaning of APY

Grasp the meaning of APY in banking and CDs with our in-depth guide. Discover how APY impacts your financial choices and maximizes your savings.

If you’ve got a low credit score, or limited credit history in the US, you may be considering getting a secured credit card to build your credit history. But what is a secured credit card and how does it work?

This guide covers how to use a secured credit card and how to build credit with a secured credit card.

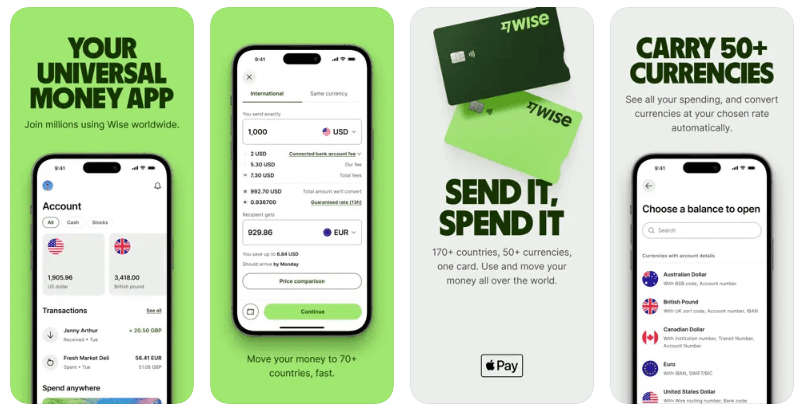

We’ll also touch on Wise, as a great way to manage your money when sending and spending foreign currencies, with great exchange rates and low, transparent fees.

Check out the Wise

debit card instead

| Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information |

|---|

Let’s start with the biggest question first — what does a secured credit card mean?

A secured credit card can be used like a regular credit card for spending and cash withdrawals. It looks just like a regular credit card, and is issued on the same popular payment networks used by regular credit cards, such as Visa®, American Express®, Discover® and MasterCard®.

You can even get a secured credit card which offers cash back or rewards on spending — just like you’d get with any other credit card.

The difference with secured cards is that you’re obliged to pay a security deposit before you can use the card, and your credit limit will be set to the amount of the deposit held by the bank or card issuer.

Deposits are usually required to be from 200 USD to around 5,000 USD, and are held by the bank, and returned when you close your card account or upgrade to an unsecured card.

Secured credit cards are available to people with low credit scores, or without a US credit history. They’re a good way to build a solid credit history through responsible card use.

Your credit history will start to be reported to major US credit bureaus when you use your secured credit card. This means you can build a better credit score as long as you’re using the card responsibly, and paying back your bills on time.

Some card issuers will also regularly review your credit score and actively help you work to move to an unsecured card if that’s what you want.

Generally to get a secured credit card you’ll need to be over 18, with a US address, bank account and phone number, as well as your SSN.

Assuming you’re eligible for the card, you can normally apply online. Some cards state that you can be approved even if you don’t have a US credit score — however, multiple factors are taken into account to assess creditworthiness, so not every applicant will be approved.

If your application is declined you should be told the basis for the decision, and what your next steps could be.

Credit cards aren’t always the right option. In particular, if you’re spending in foreign currencies — when you shop online with international retailers, or when you travel — you’ll usually find extra fees creeping in.

These foreign transaction and foreign cash fees can add 3% or more to your costs without you even realizing it.

| Instead of a credit card, check out Wise for your international money needs. You’ll get all this and more: |

|---|

|

| Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information |

|---|

If you’re eligible for a secured credit card you’ll be required to pay a security deposit, which can vary based on the card issuer’s assessment of your creditworthiness. This security deposit will be the credit limit you’re able to spend on the card.

Once you have your card, you can spend as you would with any other credit card, up to the card’s credit limit. You’ll receive a monthly bill which you’ll need to repay promptly to avoid interest charges.

Or you can choose to pay only a portion of the bill, and spread your costs over time — in this case you’ll pay interest on the outstanding balance.

The card issuer will report your credit history to one or more of the main credit bureaus in the US. This means that if you use your card responsibly and repay your balance promptly, you’ll build a credit history and a better credit score.

This can help you access more credit in future — handy if you want to take out loans or transition to an unsecured card at a later date.

Most secured credit cards will require you to pay a security deposit of between 200 USD and 5,000 USD. This money is then held separately by the card issuer — effectively as a guarantee so that if you fail to repay your card balance, the deposit can be used to offset the debt.

You’ll be able to close your secured card entirely or you may be eligible to upgrade from a secured card to an unsecured card with the same issuer if your credit score has sufficiently improved.

To close a secured credit card you’ll need to make sure your account is in good standing — with no outstanding debits, balance or penalties to pay. You’ll then need to contact the card issuer to close the account, and apply to get your deposit back.

Yes. You can get your security deposit back once you close your secured credit card account, as long as your account is in good standing and without any debts or unpaid bills.

It’s worth noting it can take a while to get your money back — up to a couple of months, depending on the card issuer.

Unsure about whether a secured credit card is right for you? Here are some pros and cons to help you decide.

| ✅ Pros | ❌ Cons |

|---|---|

|

|

A secured credit card is one of the most straightforward ways to build or improve your credit score with the major US credit bureaus.

If you’re new to the country or if you’ve simply never needed to use credit before, this can help you improve your score so that you have better access to credit products in future.

Credit scores are also used in other situations — such as screening tenants applying for a lease, which means it’s useful to have a good score even if you don’t expect to use credit cards or loans frequently.

The key downside to using a secured credit card is that you’ll have to hand over a chunk of money as a deposit, which you then can’t access as long as the card is being used.

Even once you close your secured card account, it can take a couple of months to get your money back — which can be tricky if you need it more urgently.

Aside from this, secured credit cards may have lower credit limits and higher APRs compared to unsecured cards. That means you can still rack up costs in interest and penalties, if you don’t pay off your bill on time and in full, every month.

Secured credit cards aren’t the only card type out there. As well as secured credit cards you could choose to apply for an unsecured credit card, or use a prepaid card instead.

So what’s the difference? Let’s look at how secured credit cards measure up against unsecured and prepaid cards.

Unsecured credit cards require a customer to have a strong US credit history and a high credit score.

With an unsecured credit card you don’t need to pay any deposit in advance — instead, the card issuer will give you a credit limit based on their assessment of your creditworthiness.

You’ll then be able to spend to this limit, and repay monthly — or pay interest on any outstanding balance if you choose not to repay in full.

Unsecured credit cards can have higher credit limits compared to secured cards. However, this can also mean it’s easier to build up debts, or to rack up interest and penalty charges, too.

A secured credit card looks and functions just like a credit card, in that you’ll be able to spend every month to the card’s credit limit, and will then repay your bill at the end of the month.

If you choose not to repay in full you’ll pay interest on the outstanding balance — and your credit limit will be accordingly reduced until you clear the bill in full.

Prepaid cards work a bit differently. With a prepaid card you’ll need to add funds before you can spend anything, and you’ll only ever be able to spend up to the amount you’ve added to the card balance.

This means there’s no bill to pay at the end of the month, and no interest to worry about. However, prepaid cards can come with their own fees — such as charges for adding money to your account, so they’re not necessarily entirely free ways to spend.

To help you decide if a secured credit card is right for you, let’s look at a few examples.

As you’ll see, the APRs and rewards available can vary significantly, as well as some of the features and fees you can expect. That means it’s well worth chopping around before you decide which card suits your needs best.

| Card name | Deposit required | APR | Features | Other fees |

|---|---|---|---|---|

| Discover It Secured Credit Card¹ | 200 USD — 2,500 USD | 27.24% | Earn reward points | No annual fee Cash advance fee — 10 USD or 5% of the value 41 USD late payment penalty |

| Bank of America Customized Cash Rewards Secured Credit Card² | 200 USD — 5,000 USD | 28.24% | Customized cashback | No annual fee Cash advance fee — 10 USD or 3% of the value 40 USD late payment penalty + penalty APR |

| First Progress Platinum Prestige Mastercard Secured Credit Card³ | 200 USD — 2,000 USD | 14.24% | No rewards offered | 49 USD annual fee Cash advance fee — 10 USD or 3% of the value 41 USD late payment penalty 3% foreign transaction fee |

| Capital One Quicksilver Secured card⁴ | 200 USD — 3,000 USD | 29.74% | 1.5% cashback | No annual fee Cash advance fee — 3 USD or 3% of the value 40 USD late payment penalty |

| Find the right secured credit card for you |

|---|

If you’re new to credit cards, deciding which card type will suit you can seem daunting. Here are the answers to a few more common questions about secured credit cards and how they work.

You can build a credit score with a secured credit card by using it responsibly. This can mean repaying your bill in full every month, and never spending right to the full extent of the credit limit.

Both of these behaviors will be reported by the card issuer to credit referencing bureaus and can be used to assess your creditworthiness for future credit or loan applications.

Credit card issuers report to credit bureaus monthly, based on consumer behavior in the past billing period. While the amount of time it takes for you to build a good credit score will depend on a range of factors, this can mean you’re able to boost your score sufficiently to get an unsecured credit card in around 7 months.

What is the credit limit on a secured card?

The credit limit on a secured card will normally be the same as the security deposit you pay.

Card issuers will set a security deposit and card limit based on their assessment of your income and your ability to pay. This can be between 200 USD and 5,000 USD in most cases.

Most secured credit cards can be used in exactly the same way an unsecured card is. That means you can use your secured credit card overseas when you travel, or to spend in foreign currencies when you shop online.

That said, many credit cards will have an extra fee — a foreign transaction fee — which applies whenever you spend in a foreign currency. This can push up your costs by around 3% without you even knowing it.

Once you’ve built a strong credit score you’ll normally be able to switch your secured card for an unsecured card.

Some card issuers will actively review your credit score over time, and offer you an unsecured card as soon as you’re eligible — or you could choose to apply for an unsecured card from a different card issuer, and close your secured card account entirely.

A secured card is not the same as a prepaid card. With a prepaid card you’ll need to add money to your card account before you can spend.

Then, you can spend the funds you’ve added, which will be deducted instantly from your account. There’s no monthly bill to pay, you just top up whatever you want to spend and you’re good to go.

With a secured credit card you’ll need to pay a security deposit before you can use the card. However, you’ll then be able to spend to the card limit, and will receive a bill at the end of the month.

You’ll need to repay your spending, in part or in full, and may be liable for penalty and interest charges if you do not.

So there you have it — all you need to know about secured credit cards to assess if they’re the right option for you, and get started with making an application.

Don’t forget though, that as with other card types, secured credit cards are often not a great choice for overseas spending.

Instead, you could cut your costs and get a better exchange rate if you choose a specialist debit card, like the Wise card. Open a Wise account online or in the Wise app, for free, to see how much you could save.

Unlike a credit card, debit cards have the advantage of not requiring a line of credit — you add how much you want to spend in your account and don't have to worry about paying it back once you're back from your trip.

Make the most of international spending with the Wise debit card.

Sources:

Sources checked on 02.03.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Grasp the meaning of APY in banking and CDs with our in-depth guide. Discover how APY impacts your financial choices and maximizes your savings.

Discover what FDIC insurance is, its limits, and the types of accounts it covers. Learn if your money is safe in banks, credit unions, and with CDs.

Understand the key differences between APR and APY, and how they affect your savings accounts, CDs, and even crypto investments.

Electronic money, or e-money, is a simple way to send, spend, and receive payments online. As we start to move away from cash or checks, e-money transfers are...

Wise is an online account that lets you spend abroad with your Wise card. To protect your account, we follow a set of rules set by regulatory agencies in...

Your full guide to finding the ACH routing number for your bank