Understanding the meaning of APY

Grasp the meaning of APY in banking and CDs with our in-depth guide. Discover how APY impacts your financial choices and maximizes your savings.

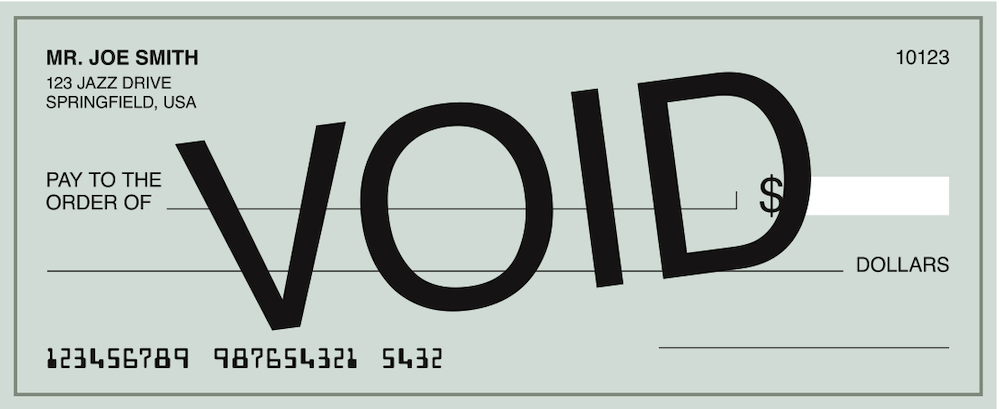

Voided checks can serve an important role in direct deposits and other ongoing transactions.

A voided check will have all of your bank information printed on it, so it can provide others everything they need to set up a direct deposit payment from your account.

If you prefer the convenience that online banking provides, then check out Wise. Wise is a safe and easy way to send, receive and manage your money without any old-fashioned banks involved.

| 📝 Table of contents |

|---|

A voided check is a check which is no longer valid and has the word ‘void’ written on the front. As such, it’s a check that banks won’t accept for payment.

So what purpose does it serve?

A voided check can be useful for providing the necessary information for certain electronic payments, such as direct debits.

Not exactly.

To void a check, you’d have to cancel it before the recipient had deposited it. But this isn’t the same as a canceled check.

A canceled check is one that the bank has already cleared. It means that the check can no longer be used after it has been cashed or deposited.

If you want to set up a direct deposit with your employer, you can’t just submit a blank check to provide your bank information, as anyone could fill out the check and take money from your account.

Instead, you’ll need to void a check.

To do that, you’ll have to write the word ‘VOID’ in capital letters going across the front of the check. Make sure you use a black or blue pen with permanent ink, and if you have a duplicate check, do the same for that copy.

Alternatively, you can write the word ‘VOID’ in any one of the following parts of the check:

No, it isn’t necessary to sign or put any information on a voided check.

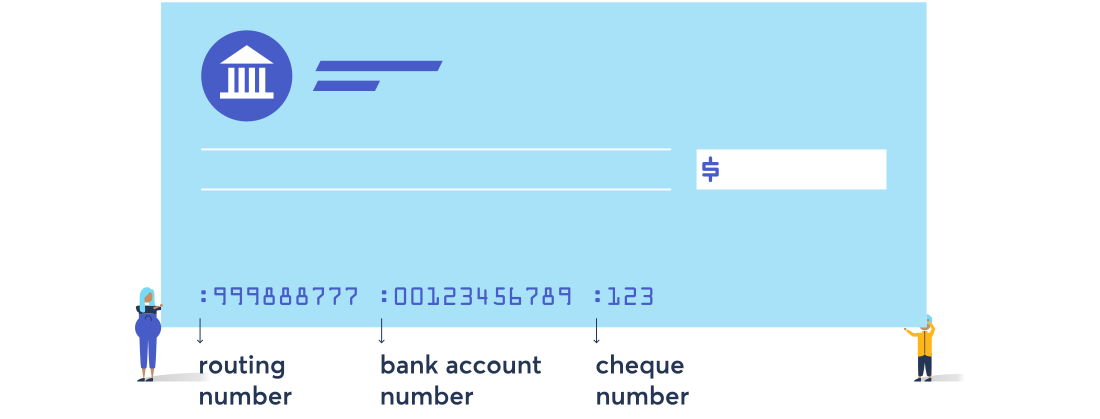

All you should see is the bank information such as your routing number, account number, and check number, and the word ‘VOID’, which you should have written on the front of the check.

You can use a voided check for several functions, including the following:

The most common use for a voided check is to establish a direct deposit¹. If you’re going to receive payments from an employer electronically, you can send them a voided check, so they have all of your bank information.

You can also use a voided check to set up automatic electronic payments, including ongoing expenses such as rent and bills.

If you add one too many ‘0s’ to your check, you can’t just correct it and hope it works out. You also can’t discard it because if someone were to get hold of it they could withdraw money from your account.

The only way to give yourself peace of mind is to void the check and then throw it out or shred it.

| 💡 If the thought of losing a check and having your money stolen gives you nightmares, it may be time to switch to something digital. Wise is a fast, safe and transparent way to send money. |

|---|

A voided check is an excellent way to set up a direct deposit with minimal effort on your part.

All you need to do if you want to establish a direct deposit is take an existing check and write the word ‘VOID’ across the front of it in large capital letters.

While you don’t strictly need a voided check to set up a direct deposit², many employers will ask for one.

This is because it is an easy and convenient way for the employer to have access to your bank information without requiring you to make a money transfer.

If you don’t have any checks, and you want to set up a direct deposit or automatic electronic payment, there are other ways to do so.

Here are some of the best workarounds if you don’t have any paper checks:

If you don’t have a paper check, you can always go to your nearest bank branch and request a voided check. Bear in mind that you may have to pay a fee for this.

Often, banks will provide instructions on how you can set up a direct deposit without a voided check. Reach out to your bank, or see if there’s any information online about how you can do this.

Your last option is to gather all your bank account information in one place so that you can fill out a form for your employer to set up a direct deposit.

This information can include your routing number, bank account number, and the name and address of your bank.

Wise offers a convenient way to send and receive money. You can open a Wise account and receive money from around the world with local bank details.

If you’re tired of dealing with paper checks and keeping records, Wise can help you manage your money electronically.

You can even directly link your Wise account to your US bank, brokerage, credit card provider, PayPal, and many other services — and automate your payments through direct debits, which are free. This is a great option for paying bills.

Signing up is free and easy, and you can wave goodbye to those checks.

Get a Wise account in minutes ⏱

| 🤓 More useful articles you’ll love |

|---|

Sources:

All sources checked 21 April 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Grasp the meaning of APY in banking and CDs with our in-depth guide. Discover how APY impacts your financial choices and maximizes your savings.

Discover what FDIC insurance is, its limits, and the types of accounts it covers. Learn if your money is safe in banks, credit unions, and with CDs.

Understand the key differences between APR and APY, and how they affect your savings accounts, CDs, and even crypto investments.

Electronic money, or e-money, is a simple way to send, spend, and receive payments online. As we start to move away from cash or checks, e-money transfers are...

Wise is an online account that lets you spend abroad with your Wise card. To protect your account, we follow a set of rules set by regulatory agencies in...

Your full guide to finding the ACH routing number for your bank