Understanding the meaning of APY

Grasp the meaning of APY in banking and CDs with our in-depth guide. Discover how APY impacts your financial choices and maximizes your savings.

These days it’s pretty common to see QR codes used for everything from allowing you to scan and read more about an advert you’ve seen in a magazine, to QRs used to access restaurant menus, and QR codes displayed for customer payments in stores.

But how does a QR code payment work? What do you do if you want to pay with a QR code? And can you use a QR code for making a transfer to a friend?

This guide covers all you need to know about how to pay with a QR code — and we’ll also touch on Wise as a great way to pay friends, family and businesses overseas, online and in-app.

QR stands for Quick Response. A QR code is a square patterned image, which contains encoded data — much like a barcode you’ll see on items in the store, but with the option to hold far more information.

QR codes are used for loads of things these days — including payments you make online, in person in stores, and peer to peer payments sent to friends.

To make a QR code payment you’ll need to scan a QR code, usually with your smartphone’s camera.

Then, depending on the way it’s been set up you’ll be able to enter the amount you need to pay, and transfer money — either by adding your card details, using an ewallet like Apple Pay or Google Pay, or using another alternative payment service.

While you may not spot it, there are actually a couple of different types of QR code, known as static and dynamic QR codes.

Static codes can not be altered once they’ve been created, while dynamic QR codes can be more easily edited and shared.

Both are broadly used across everything from marketing and data collection to money transfers and payments.

QR code payments are offered by lots of different QR code payment companies. However, you’ll often find they’re only available for domestic transfers in USD.

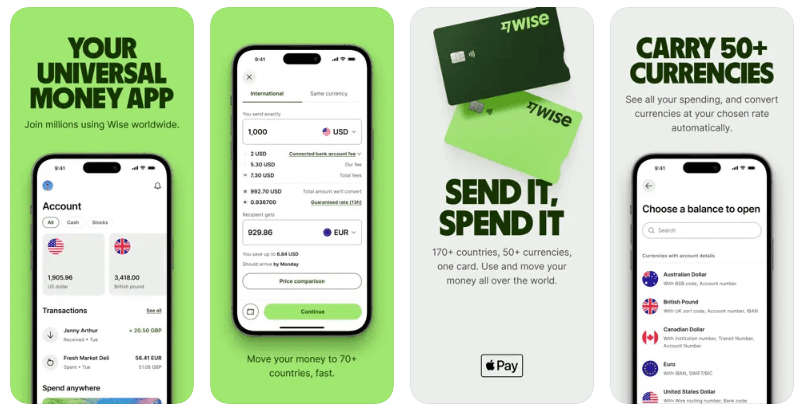

If you need to send money to someone overseas, check out Wise instead. You can set up a Wise payment easily online or in the Wise app, and send money to bank accounts in 80+ countries, in 50+ currencies.

Wise always uses the mid-market exchange rate — the one you’ll find on Google — and low, transparent fees you can check and compare before you confirm your transfer.

Next time you need to send money overseas, check out Wise to see if you can save.

Get a Wise Account

in minutes 🚀

| Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information |

|---|

So now we’re all clear on what a QR payment is, let’s look at how to set up a QR code for payment, either by scanning someone else’s code, or having them scan yours.

One of the easiest ways to make a QR payment is to simply scan the recipient’s QR code with your smartphone’s camera app. Your camera will recognize it as a QR and a message will appear asking you to tap the screen to follow the link that’s encoded in the QR.

Depending on the way the QR code has been set up, this may then take you to a specific payment gateway or mobile wallet.

Venmo, for example, allows business customers to generate a QR for payments¹, which can either include a pre-set price, or allows customers to enter the payment details for their specific payment. Venmo also offers personal customers the option to generate their own QR to get paid by friends².

In some cases, merchants can also scan your QR to process a payment from your phone.

Again, this will depend on whether or not the merchant accepts payments through the same QR payment app you use, or one that’s compatible with it.

If you’ve both got the same QR payment app, the merchant can scan your code with their own phone or with a handheld barcode reader, to initiate the payment.

Some payment platforms — such as Venmo — let you generate your own QR code, which you can have someone else scan to make you a payment.

This means transfers are as simple as opening your phone camera and adding a payment amount and message — no need for bank information or account numbers.

Let’s take a look at some of the benefits and drawbacks of QR payments — either as an individual or for businesses.

| ✅ Pros | ❌ Cons |

|---|---|

|

|

QR payments — both for businesses and for peer to peer payments — are easy to use and secure. As we pretty much all carry smart phones — all the time — they’re also fairly accessible to most people.

Setting up QR payments is fast, and individuals and businesses can generate their own codes instantly with some providers.

There are huge numbers of different QR code payment companies out there — which can be problematic as they’re not all compatible with each other.

If you want to receive a payment from someone you’ll need to have the same app — or one which is compatible — to allow it to work.

Also, for business owners in particular, QR codes can’t usually be the only payment method used — just for those odd occasions when a customer may leave home without their smart device.

QR code payments are generally very secure. All the data which is transferred when you use the QR is encrypted for security, making this a safe process to use.

Whether or not you pay to use a QR code payment will depend on the specific app or platform you use, and whether you’re a personal or business customer.

Generally, if you want to use QR code payments as a business owner you’ll have to pay a fee. This is usually similar to the charge levied if you’re accepting a card payment online.

As a personal customer, you can often scan a merchant’s or a friend’s QR code to make a payment. Whether or not there’s a fee to pay will then depend on the specific app you choose and how you wish to pay — in most cases the app or platform’s fee will be the same as making any other payment with that provider.

Finally, let’s round up with a few use cases, so you can see how handy QR payments can really be:

|

|---|

QR payments are secure, fast and convenient. Whether you’re a small business owner looking for easier ways for customers to pay, or you just want to send some money over to a friend to pay back a bill, there’s a QR code payment option for you.

Use this guide to get you started, and don’t forget to take a look at Wise next time you want to send money overseas — for low cost transfers with the Google rate.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Grasp the meaning of APY in banking and CDs with our in-depth guide. Discover how APY impacts your financial choices and maximizes your savings.

Discover what FDIC insurance is, its limits, and the types of accounts it covers. Learn if your money is safe in banks, credit unions, and with CDs.

Understand the key differences between APR and APY, and how they affect your savings accounts, CDs, and even crypto investments.

Electronic money, or e-money, is a simple way to send, spend, and receive payments online. As we start to move away from cash or checks, e-money transfers are...

Wise is an online account that lets you spend abroad with your Wise card. To protect your account, we follow a set of rules set by regulatory agencies in...

Your full guide to finding the ACH routing number for your bank