Wat is Automatische incasso-geldoverschrijving?

Of je het nu een automatische incasso of een EFT noemt, overschrijvingen via automatische incasso zijn vaak een van de goedkoopste manieren om een internationale Wise-betaling te doen. Het regelen van een automatische incasso naar Wise is handig. Je kunt dit vaak online doen of in je mobiele bankapp, dus je hoeft niet eens het huis uit.

Je kunt een Wise-overschrijving via automatische incasso doen tot 9.500 CAD in 24 uur vanaf een persoonlijke rekening. Er geldt ook een limiet van 30.000 CAD per week. Je kunt ook betalingen via automatische incasso sturen vanaf een zakelijke bankrekening, zolang je een zakelijk Wise-account hebt.

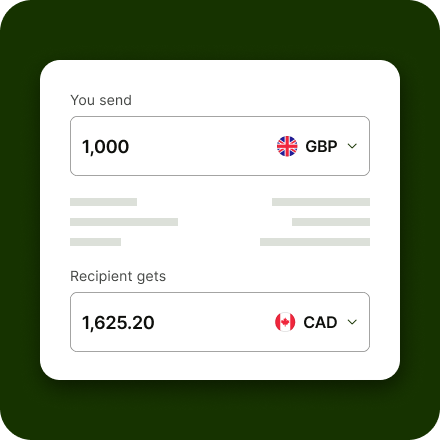

Wanneer je een Wise-overschrijving instelt en via automatische incasso betaalt, is de wisselkoers gegarandeerd zodra je de betaling aan Wise autoriseert. Dat betekent dat je niet voor verrassingen komt te staan als de koersen veranderen terwijl je automatische incasso onderweg is naar Wise. Je weet meteen precies hoeveel je overschrijving je gaat kosten en welke koers je krijgt.

Lees meer over het gebruik van overschrijvingen via automatische incasso.