What is Google Pay money transfer?

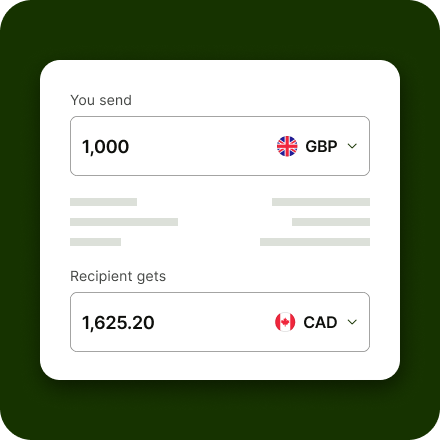

Making a Google Pay money transfer is super convenient. You’ll get the benefits of paying by debit or credit card - without any of the hassle of entering your card details. Just use your phone’s PIN or biometric log in, for a transfer you can set up in seconds.

Google Pay money transfers with Wise have maximum payment limits which vary based on where in the world you’re based. There are also a couple of other specific circumstances in which you won’t be able to make a Wise Google Pay money transfer.

If your specific payment can be funded using Google Pay you’ll see this option when you arrange it - and if you don’t, you can easily pick another payment type to get your money on its way.

Learn more about using Google Pay transfers.