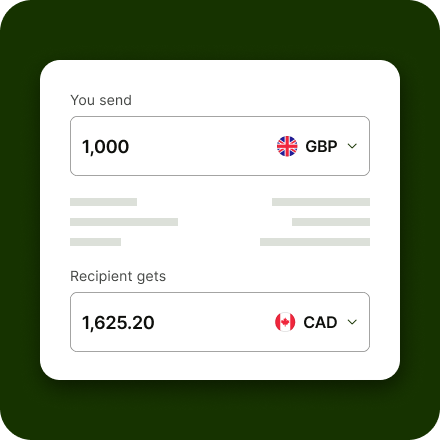

What is Apple Pay money transfer?

Making an Apple Pay money transfer is super convenient. You’ll get the benefits of paying by debit or credit card - without any of the hassle of entering your card details. Just use your phone’s PIN or biometric log in, for a transfer you can set up in seconds.

Apple Pay money transfers with Wise have maximum payment limits which vary based on where in the world you’re based. There are also a couple of other specific circumstances in which you won’t be able to make a Wise Apple Pay money transfer.

If your specific payment can be funded using Apple Pay you’ll see this option when you arrange it. If you don’t see Apple Pay as an available option, you can easily pick another payment type to get your money on its way.

Learn more about using Apple Pay transfers.