What is PISP money transfer?

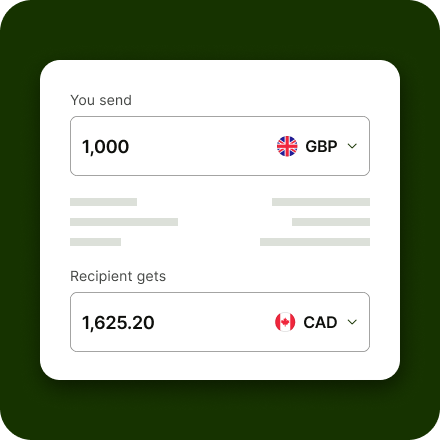

Sending a PISP Open Banking money transfer is an easy way to pay in GBP from your UK bank, when you want to move money overseas.

Wise offers 2 Open Banking payment options: one off payments, and individual or repeat pull of funds payments. Making a one off payment using PISP is convenient because you’ll be redirected to your bank from Wise, with your payment details pre-populated. If you choose to then link your bank account with Wise, you’ll be able to make future international transfers without the need to log into your online banking every time.

You can send a PISP payment with Wise, up to the payment limits set by your own bank. Different banks have their own maximum open banking caps, but these are usually from about 10,000 GBP per transfer to about 50,000 GBP per transfer.

Learn more about using PISP.