PayPal Fee Calculator UK

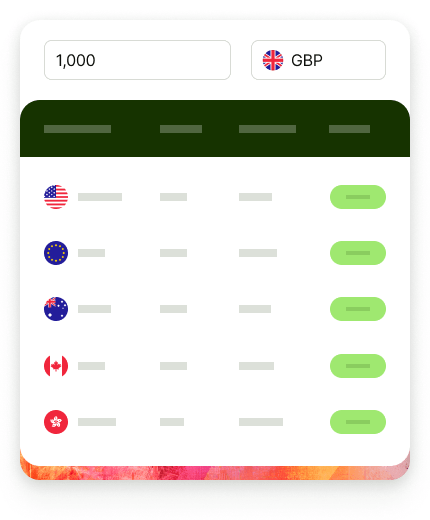

PayPal merchant fees are confusing. Use this simple calculator to find out how much PayPal will charge you, wherever your customers are.

Get a business account that is up to 5x cheaper than PayPal

As well as merchant fees, you’ll also face PayPal charges if you receive payments from a different country or currency. PayPal adds a markup to the exchange rate used to convert your money back to pounds which might mean you get less than you expect when you withdraw your PayPal balance.

Avoid PayPal currency fees by withdrawing your balance to the Wise multi-currency account and save even more when you use Wise to send and receive money internationally. See the market research here

Other useful calculators

PayPal Exchange Rate Calculator

View and calculate the PayPal exchange rate for your international money transfers.

eBay Calculator

Calculate the eBay fees you’ll need to pay, so you can set your product prices to cover the costs, and protect your profits.

PayPal fees for sellers: What's domestic vs international?

PayPal UK fees vary depending on whether the payment is considered domestic or international.

Domestic payments: The person sending and the person receiving the payment both have PayPal accounts registered in the same country/territory.

International payments: Sender and receiver PayPal accounts are registered in different countries/territories. Some exceptions apply, where country groupings are used to calculate international transaction rates.

For example, euro and Swedish krona transactions count as domestic payments if both the sender and the receiver are registered with PayPal in the European Economic Area (EEA).

Check out the PayPal Country/Territory Grouping Table for more information.

Standard rate for receiving domestic transactions with PayPal

Here are the PayPal fees for domestic transactions:

-

2.9% of the transaction value if the recipient is based in the UK

-

3.4% of the transaction amount if the recipient lives in: Romania, Bulgaria, Greece, Latvia, San Marino, Cyprus, Liechtenstein, Slovakia, Czech Republic, Hungary, Lithuania, Slovenia, Estonia, Malta

You’ll also pay a fixed fee which is based on the received currency

For PayPal accounts registered in a few countries the percentage PayPal charges will change based on the value of commercial transactions received. In general, the more you receive via PayPal, the lower your rate becomes.

Sounds complicated? If you want to use our calculator to do the maths for you, get it here.

| Country of recipient's (seller's) address | PayPal Fee |

|---|---|

Gibraltar, Guernsey, Isle of Man, Jersey & United Kingdom (UK) | 2.90% + fixed fee |

Romania, Bulgaria, Greece, Latvia, San Marino, Cyprus, Liechtenstein, Slovakia, Czech Republic, Hungary, Lithuania, Slovenia, Estonia, Malta | 3.40% + fixed fee |

PayPal’s Fixed fee based on received currency

PayPal’s Fixed fee based on received currency

| Currency | Fixed fee |

|---|---|

Australian dollar | 0.30 AUD |

Brazilian real | 0.60 BRL |

Canadian dollar | 0.30 CAD |

Czech koruna | 10.00 CZK |

Danish krone | 2.60 DKK |

Euro | 0.35 EUR |

Hong Kong dollar | 2.35 HKD |

Hungarian forint | 90.00 HUF |

Israeli new shekel | 1.20 ILS |

Japanese yen | 40.00 JPY |

Malaysian ringgit | 2.00 MYR |

Mexican peso | 4.00 MXN |

New Taiwan dollar | 10.00 TWD |

New Zealand dollar | 0.45 NZD |

Norwegian krone | 2.80 NOK |

Philippine peso | 15.00 PHP |

Polish zloty | 1.35 PLN |

Russian ruble | 10.00 RUB |

Singapore dollar | 0.50 SGD |

Swedish krona | 3.25 SEK |

Swiss franc | 0.55 CHF |

Thai baht | 11.00 THB |

UK pounds sterling | 0.30 GBP |

US dollar | 0.30 USD |

PayPal’s fees for receiving an international transaction

PayPal’s fees for receiving an international transaction

| Country of the sender (your customer) | Fee |

|---|---|

Canada & US | 2.00% |

Austria, Belgium, Channel Islands, Cyprus, Estonia, France (including French Guiana, Guadeloupe, Martinique, Reunion and Mayotte), Germany, Gibraltar, Greece, Ireland, Isle of Man, Italy, Luxembourg, Malta, Monaco, Montenegro, Netherlands, Portugal, San Marino, Slovakia, Slovenia, Spain, United Kingdom, Vatican City State. | 0.50% |

Slovakia, Slovenia, Spain, United Kingdom, Vatican City State. Europe II Albania, Andorra, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Georgia, Hungary, Kosovo, Latvia, Liechtenstein, Lithuania, Macedonia, Moldova, Poland, Romania, Russian Federation, Serbia, Switzerland, Ukraine. | 2.00% |

Aland Islands, Denmark, Faroe Islands, Finland, Greenland, Iceland, Norway, Sweden. | 0.50% |

Rest of the world | 2.00% |

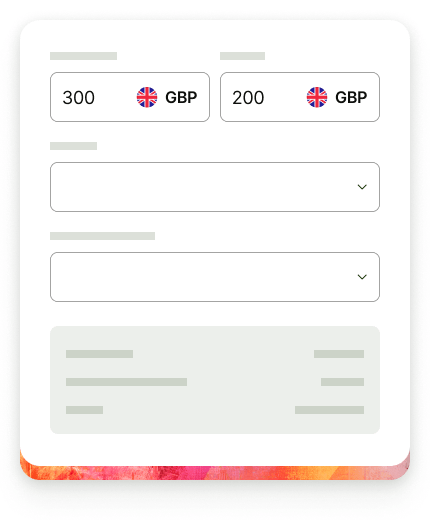

PayPal’s fee for currency conversion

If you’re selling to customers based abroad and receive a payment in a currency different to the default currency of your PayPal merchant account, you’ll pay an extra fee for currency conversion.

This charge is applied as a mark up on the exchange rate, or as PayPal calls it, the “transaction rate”, and means you pay 2.5% of the transaction value to convert your money back to pounds.

Example of a calculation: if the base rate for EUR/GBP is 0.9036 , the transaction rate will be 0.8810 (rate * 0.975).

PayPal’s other merchant fees

That’s not all. There may be other fees if you use PayPal to collect payments from your customers, such as:

-

Advanced Credit and Debit Card Payments if you use PayPal to add credit card buttons to your website for easier card payment

-

Alternative Payment Method Rates for example if you offer real time bank transfers with a third party provider

-

New Checkout Solution which allows eligible businesses to take card payments

-

PayPal Here Rates (applicable for UK, GG, GI, JE, & IM only) when you take in person card and contactless payments

-

PayPal Website Payments Pro and Virtual Terminal Rates for integrated online and in person payments

-

Mass Payments used to organise and mail payments to many people at once

-

Micropayments for eligible businesses processing payments under £5

-

QR Code Fees if you accept payments through a QR code, there will be a fixed fee for QR code transactions based on the currency received and whether the amount is above or below £10.01

PayPal fees FAQs.

Wise is your easy, cheap alternative to a bank account abroad

Open online in just a few steps, with no monthly fees and no minimum balance - just simple currency services using the real exchange rate.