What is the cheapest way to send money abroad?

Create a free account today and start saving on your money transfers.

Should arrive by Thursday

Find the cheapest international money transfer

| Sending 1,000 CAD with | Recipient gets(Total after fees) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 725.45 USD | ||||||||||

Transfer fee 7.40 CAD Exchange rate(1 CAD USD) 0.730861 Exchange rate markup 0.15 CAD Cost of transfer 7.55 CAD | |||||||||||

| 725.32 USD- 0.13 USD | ||||||||||

Transfer fee 0 CAD Exchange rate(1 CAD USD) 0.725324 Exchange rate markup 7.72 CAD Cost of transfer 7.72 CAD | |||||||||||

| 723.72 USD- 1.73 USD | ||||||||||

Transfer fee 1.99 CAD Exchange rate(1 CAD USD) 0.725160 Exchange rate markup 7.94 CAD Cost of transfer 9.93 CAD | |||||||||||

| 722.05 USD- 3.40 USD | ||||||||||

Transfer fee 0 CAD Exchange rate(1 CAD USD) 0.722049 Exchange rate markup 12.20 CAD Cost of transfer 12.20 CAD | |||||||||||

| 713.49 USD- 11.96 USD | ||||||||||

Transfer fee 3.99 CAD Exchange rate(1 CAD USD) 0.716352 Exchange rate markup 19.99 CAD Cost of transfer 23.98 CAD | |||||||||||

| 712.93 USD- 12.52 USD | ||||||||||

Transfer fee 0 CAD Exchange rate(1 CAD USD) 0.712926 Exchange rate markup 24.68 CAD Cost of transfer 24.68 CAD | |||||||||||

| 712.18 USD- 13.27 USD | ||||||||||

Transfer fee 1.99 CAD Exchange rate(1 CAD USD) 0.713596 Exchange rate markup 23.76 CAD Cost of transfer 25.75 CAD | |||||||||||

| 711.91 USD- 13.54 USD | ||||||||||

Transfer fee 0 CAD Exchange rate(1 CAD USD) 0.711912 Exchange rate markup 26.07 CAD Cost of transfer 26.07 CAD | |||||||||||

| 708.31 USD- 17.14 USD | ||||||||||

Transfer fee 15 CAD Exchange rate(1 CAD USD) 0.719092 Exchange rate markup 16.25 CAD Cost of transfer 31.25 CAD | |||||||||||

| 700.17 USD- 25.28 USD | ||||||||||

Transfer fee 2.99 CAD Exchange rate(1 CAD USD) 0.702267 Exchange rate markup 39.26 CAD Cost of transfer 42.25 CAD | |||||||||||

See why customers choose Wise for their international money transfers

It’s your money. You can trust us to get it where it needs to be, but don’t take our word for it. Read our reviews at Trustpilot.com.

Best ways to send money internationally

Bank Transfer

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option.Direct Debit

Direct Debit is a convenient option that lets us take money from your account once you have authorised the payment on our site. It takes a little more time for your money to reach Wise, and it can be more expensive than a bank transfer.Debit Card

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process. Read more about how to pay for your money transfer with a debit card.Credit Card

Paying for your transfer with a credit card is easy and fast. Wise accepts Visa, Mastercard and some Maestro cards. Read more about how to pay for your money transfer with a credit card.Apple Pay

If you’ve enabled Apple Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Apple Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.Google Pay

If you’ve enabled Google Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Google Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.

How to send a cheap money transfer in 3 easy steps

Choose your payment method

Funding your money transfer with a bank transfer is usually the cheapest way to send money abroad.

Get the cheapest rate possible.

Wise always gives you the real and fair mid-market exchange rate. If the rate is not good right now, sign up for Rate alerts to receive an email notification when the rate changes.

Send CAD, receive USD.

The recipient gets money in their currency directly to their bank account.

Things to consider to find a truly cheap way to send money abroad

Fees

Many businesses state low fees or even offer consumers fee-free transfers, but most of the expense of sending money abroad is hidden. The bulk of consumer costs can be concealed in poor exchange rates.

Exchange rates

A quick Google search will show you an exchange rate. But if you compare it to the exchange rate offered by banks and traditional money transfer services, you’ll find their rate is often much worse.

Transfer time

Traditional banks and international money remittances often take several working days. Wise is often much faster: a lot of transfers are completed within 1 business day. Many of our transfers are even instant.

Protecting you and your money

Safeguarded with leading banks

We hold your money with established financial institutions, so it's separate from our own accounts and in our normal course of business not accessible to our partners. Read more here.

Extra-secure transactions

We use 2-factor authentication to protect your account and transactions. That means you — and only you — can get to your money.

Data protection

We’re committed to keeping your personal data safe, and we’re transparent in how we collect, process, and store it.

Dedicated anti-fraud team

We work round the clock to keep your account and money protected from even the most sophisticated fraud.

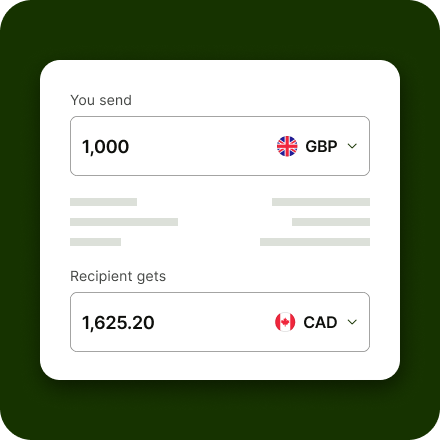

Sending money is cheap with the Wise app

Looking for an app to send money with low fees? Sending money is easy with Wise app.

- Cheaper transfers abroad - free from hidden fees and exchange rate markups.

- Check exchange rates - see on the app how exchange rates have changed over time.

- Repeat your previous transfers - save the details, and make your monthly payments easier.